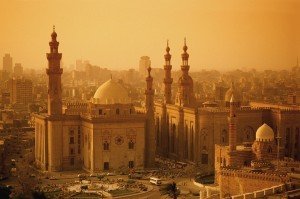

According to JLL, Cairos residential property market is displaying positive signs. In particular, there are indications that the market in Egypts capital strengthened over the second quarter of last year, partly thanks to a number of new projects that have been announced.

According to JLL, Cairos residential property market is displaying positive signs. In particular, there are indications that the market in Egypts capital strengthened over the second quarter of last year, partly thanks to a number of new projects that have been announced.

2014 saw sale prices for apartments and villas in the city strengthen across the board, according to a report from JLL. Furthermore, most locations in Cairo have shown year-on-year growth in the rental market.

The last quarter of the year saw especially strong growth in New Cairo for apartment rents (which showed a 7% increase) and sale prices of villas (which rose by 9%). Sales figures are on the rise, thanks in part to the fact that Egypt has achieved a more positive position both politically and economically after its recent struggles. This is strengthening the market and serving to attract new investments, especially at the more premium end of the market, which in turn strengthens the market further.

The office sector in Cairo, meanwhile, has remained almost completely stable over the past quarter, JLL reports. All commercial locations in the city showed rents for offices remaining steady. Similar stability was seen in the retail sector, which saw high demand and decreasing vacancy rates but relatively unchanging rents. Much of the new wave of retail demand has come from the food and beverage sector, and this has helped decrease vacancy rates from 23% in Q3 to 19% in Q4.

Overall, commercial rents saw an increase in enquiry volumes but a decrease in occupancy levels. Vacancy rose to 35% in those buildings that JLL monitors in order to produce its report. This is partly due to an increase in volume which demand has been unable to fully absorb. The past year has seen an extra 85,000 square meters added to Cairos commercial property stock.

One of the most notable completions in the final quarter of 2014 was in Mivida, New Cairo, and introduced an extra 14,000 square meters of floor space. 2015 is forecast to see an extra 52,000 square meters added, and a formidable 31,000 square meters of this total are expected in the first quarter alone. This will leave the Greater Cairo area with total stock of around 955,000 square meters.

The hotel sector, meanwhile, saw the handover of the Nile Ritz Carlton delayed from the fourth quarter of 2014. Representing 331 keys, this brings the expected total supply for 2015 to the level of 623 keys.

Novembers year-to-date occupancy rates are down compared to those seen in 2013, but there was an impressive 78% improvement in the average daily rate (ADR). This is partly thanks to recent initiatives from the government, which have sought to give a boost to room rates from scrapped fuel subsidies.

Author Bio

Hopwood House are property investment specialists with a large portfolio of investment opportunities at home and abroad, including property for sale in Egypt, Thailand, Dubai, Spain the US and in the UK student property market.

- Selling a House in a Trust After Death: What You Should Know - April 18, 2024

- Maximising Your Home’s Potential: The Ultimate Renovation Checklist - April 16, 2024

- Key Tips on Managing Your Property Portfolio - April 16, 2024