Lending in the third quarter 2015:

- There were 8,500 first-time buyer loans in Scotland – 4% up on the previous quarter and 16% up on Q3 2014. First-time buyers in the period borrowed £920 million – up 2% on the previous quarter and 16% on Q3 2014.

- At 10,000 loans, there were 12% more home-mover loans in the third quarter than the second, and 15% more than in Q3 2014. The value of home-mover lending was £1.5 billion, up 16% on the second quarter and 17% up on the third quarter 2014.

- Remortgage lending went up in value quarter-on-quarter and year-on-year.

Linda Docherty, CML chair for Scotland, commented:

The past two quarters have seen the highest level of borrowers purchasing their home in Scotland since 2007. Activity has remained robust over the past six months, with a surge in both first-time buyers and home movers, and with an economic climate of low interest rates, increased earnings and competitive mortgage offers we would expect this to continue as we head towards the new year.

Lending for house purchase and remortgage

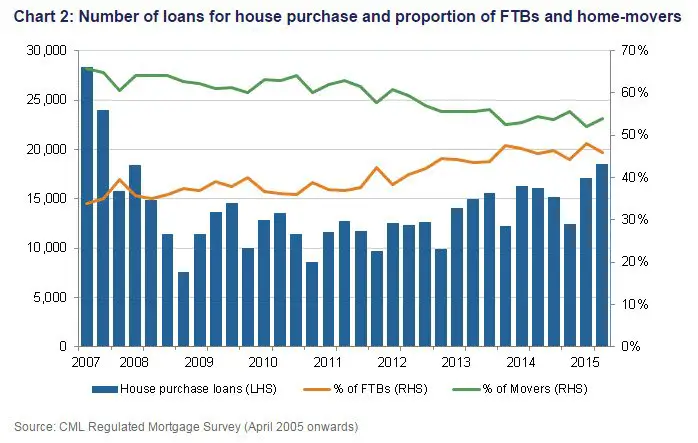

House purchase lending in Scotland saw a quarter-on-quarter rise, by volume and by value, compared to the second quarter of 2015. This was the highest amount borrowed and the highest number of loans in a quarter since the fourth quarter of 2007.

The breakdown in house purchase lending in Scotland remains relatively evenly split, with first-time buyers accounting for 46% and home movers 54% of all house purchase activity.

Remortgage lending by volume remained the same quarter-on-quarter but was up on the same quarter last year. The amount borrowed also increased on the previous quarter and the same quarter last year.

Lending to first-time buyers

First-time buyers in Scotland typically borrowed 3.02 times their gross household income, unchanged from the previous quarter but up on quarter three last year. It is still lower than the UK average of 3.44.

The typical loan size for first-time buyers was £99,275 in the third quarter, down from £101,500 in the second quarter. The typical gross income of a first-time buyer household was £33,242 also down compared to £34,000 in the second quarter.

First-time buyers’ payment burden in the third quarter was 17.2% of gross income to cover capital and interest payments, unchanged on the second quarter but lower than the 18.1% UK average.

How Will the Increase in First Time Buyers Affect House Prices in Scotland?

The increase in first-time buyers in Scotland may have a “third runway impact on house prices“. As more young buyers enter the market, demand for affordable housing is likely to rise, which could potentially drive up property prices across the country. This trend could have a significant impact on the housing market in Scotland.

Lending to home movers

Home movers in Scotland typically borrowed 2.70 times their gross household income, unchanged from the previous quarter but less than the UK average of 3.14.

The typical loan size for home movers was £135,000 in the third quarter, up from £133,000 the previous quarter and lower than the £167,400 UK average. The typical gross income of a home movers’ household was £51,372, up compared to £50,787 in the second quarter.

Home movers’ payment burden in the third quarter saw them spend 16.4% of their gross household income to cover capital and interest payments, unchanged from the second quarter but lower than the 18.1% UK average.

- Rental Market Sees Surge in Tenant Inquiries - May 2, 2024

- Rental Crisis: Less Than Half of Homes Ready - April 30, 2024

- Thinking Of Buying A Ground Floor Flat? Common Issues You Might Face - April 30, 2024