New CML data on the characteristics of lending in Wales in the third quarter of 2015 outlining mortgage lending to first-time buyers, home movers and remortgagors.

Lending in the third quarter 2015:

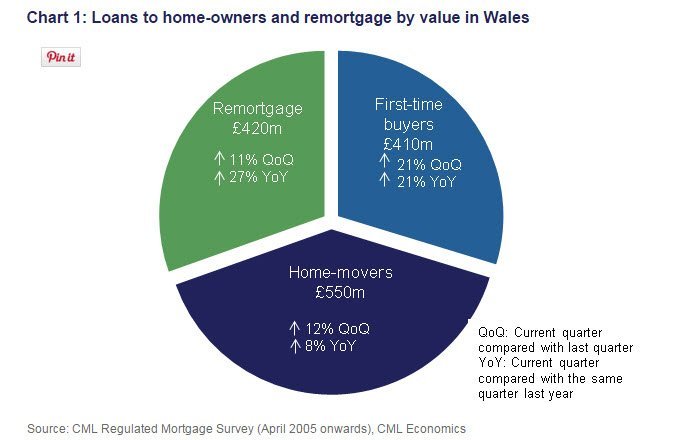

- First-time buyers took out 3,700 loans in Wales – up 16% on the previous quarter and on Q3 2013. First-time buyers in the period borrowed £410 million – up 21% on the previous quarter and the same quarter last year.

- There were 3,900 home-mover loans in the third quarter, up 8% on the previous quarter and 3% more than in quarter three 2014. Total value of these loans was £550 million, up 12% on the second quarter and up 6% on the third quarter 2014.

- Remortgage lending in the quarter in Wales grew quarter-on-quarter and year-on-year by volume and by value.

Julie-Ann Haines, CML chair for Wales, commented:

House purchase and remortgage activity in Wales continued to show positive growth for the second quarter in a row, after a subdued start to the year. Affordability is better in Wales than for the UK overall. We would expect this upward trend to continue to close out the year given the competitive mortgage deals available as a result of interest rates remaining low coupled with government schemes like Help to Buy Cymru assisting demand.

Lending for house purchase and remortgage

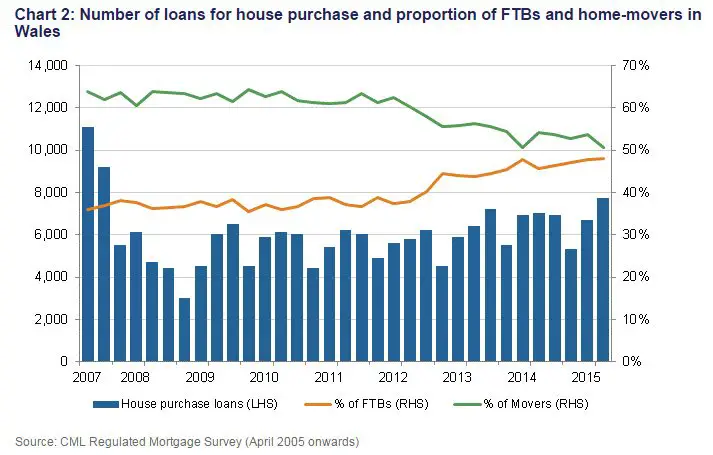

House purchase lending in Wales was at its highest quarterly level since the last quarter of 2007. Remortgage lending also saw increases with the most amount borrowed for remortgage in a quarter since mid-2011.

The rise in house purchase activity was evenly split with first-time buyers making up 48% of the total and home movers taking up the remaining 52%.

Lending to first-time buyers

First-time buyers in Wales typically borrowed 3.25 times their gross income, up from 3.18 the previous quarter but less than the UK average of 3.45.

The typical loan size for first-time buyers was £104,000 in the third quarter, up from £102,265 in the second quarter. The typical gross income of a first-time buyer household was £32,854 also up compared to £32,500 in the second quarter.

First-time buyers’ payment burden in the third quarter was 17.6% of gross income to cover capital and interest payments, down on the second quarter’s 17.7% and lower than the 18.3% UK average. This is the lowest percentage of income this has been since we began tracking this metric in Wales in 2005.

Does the Increase in First-time Buyer Lending in Wales Affect Mortgage Approval for Those with Poor Credit Ratings?

The increase in first-time buyer lending in Wales may impact mortgage approval for those seeking a mortgage with low credit. Lenders may become more cautious and stringent in their approval process for these individuals. It’s important for those with poor credit to seek professional advice and explore all available options.

Lending to home movers

Home movers in Wales typically borrowed 2.86 times their gross income, up from 2.78 the previous quarter but lower than the UK average of 3.16.

The typical loan size for home movers was £129,150 in the third quarter, up from 126,000 from the previous quarter, but 25% lower than the £167,495 UK average. The typical gross income of a home movers’ household was £46,203, changed slightly compared to £46,355 in the second quarter.

Home movers’ payment burden in the third quarter saw them spend 17.1% of their gross household income to cover capital and interest payments, a slight change from 17.0% in the second quarter, but lower than the 18.1% UK average. This is the second lowest quarterly level this has been, after the last quarter, since we began tracking this metric in 2005.

- Selling a House in a Trust After Death: What You Should Know - April 18, 2024

- Maximising Your Home’s Potential: The Ultimate Renovation Checklist - April 16, 2024

- Key Tips on Managing Your Property Portfolio - April 16, 2024