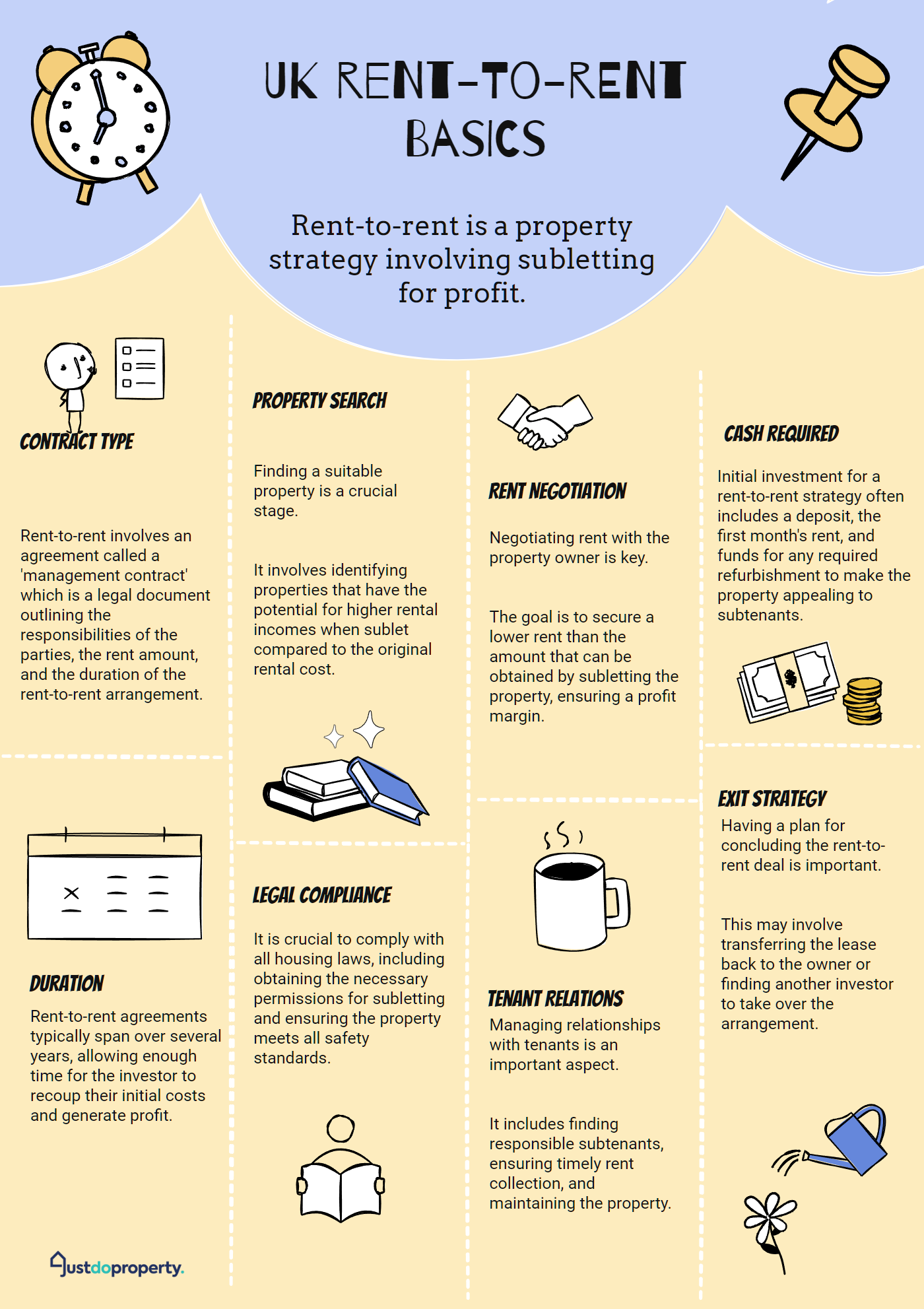

A rent-to-rent agreement is when you rent a property from a landlord and then rent it out to others at a higher price to make a profit. This lets you get into the property market without needing a big upfront payment. You’ll basically be the middleman, taking care of finding tenants and looking after the property. It’s important to have clear contracts that spell out who is responsible for what and to make sure everyone is protected.

You need to follow the law by doing safety checks and having the right insurance in place. Knowing the rental market well and understanding different ways to do rent to rent, like guaranteed rent or lease option agreements, can help you succeed. There’s a lot to learn and explore in the world of rent to rent.

Definition of Rent to Rent

Rent-to-rent is when you rent a property from someone else and then turn around and rent it out to others at a higher price to make a profit. It’s a way to get into the property market without needing a lot of money upfront. Basically, you act as the middleman, making money from the difference between what you pay in rent to the owner and what you charge your tenants.

To do well in rent to rent, you need to check for risks. You want to be sure that you can find tenants who are willing to pay the higher rent you want to charge. Knowing the local rental market and demand is important. Also, you should look at the property’s condition and location to reduce possible risks. Keep in mind that you’ll have to take care of the property and make sure it stays attractive to tenants.

Being part of a rent-to-rent group lets you share experiences and learn from others. This community can give you good tips on how to make more money while lowering risks.

If you do your research and stay connected with others, rent to rent can be a profitable venture.

Legal Considerations

When you’re managing a rent-to-rent agreement, it’s crucial to understand your responsibilities under the contract. This ensures that everyone involved is protected.

It’s important to know how tenant rights are upheld and what the landlord’s obligations are in these agreements. Remember, a clear and legally sound contract is your best protection against possible disagreements.

Contractual Obligations Defined

In order to ensure a smooth and legally sound rent-to-rent agreement, it’s important to clearly outline the responsibilities of all parties involved. This means clearly stating the rights of tenants and the maintenance duties for the property in the lease agreements. As the middleman between the property owner and the tenant occupants, it’s crucial to have everything spelled out clearly.

Start by defining your responsibilities for property upkeep in your agreement with the property owner. This may involve regular checks, repairs, and ensuring the property meets safety standards.

The tenant’s rights should also be clearly outlined in the contract with the occupants. They should be aware of their entitlements, like prompt repairs and suitable living conditions.

Beyond the written contract, there are other legal aspects to consider. You’ll need permissions from freeholders and mortgage lenders, carry out necessary safety checks, and adhere to insurance and property redress scheme rules.

It’s wise to consult with a property lawyer familiar with rent-to-rent setups. This way, you can ensure that every detail of your agreement complies with Housing Act regulations, safeguarding all parties involved and promoting trust and cooperation.

Tenant Rights Protection

Protecting your rights as a tenant in rent-to-rent agreements is crucial. You want to make sure you’re covered by housing laws that guarantee your well-being. Rent to rent operators must follow these laws to provide you with a safe place to live. If they don’t, you could end up dealing with issues like poor living conditions or sudden evictions.

Legal stuff is a big deal in these agreements. If operators sublet properties without the right legal paperwork, it can lead to problems and violations of your rights. It’s important to know your rights and what you can do if they’re not being respected. For example, you have the right to live in a safe place and to know who’s in charge of managing the property.

If you run into any disagreements, getting advice from legal experts can help protect you. They can walk you through the ins and outs, making sure your rights are upheld, and any legal issues are sorted out. Taking this proactive approach can prevent conflicts and ensure you’re part of a community that respects tenant rights.

Landlord Responsibilities Explained

Understanding tenant rights is important, but as a landlord in a rent to rent agreement, you have legal responsibilities to uphold as well. It’s not just about handing over keys; you need to make sure you’re following your mortgage terms and that your insurance covers rent to rent arrangements. Take the time to do your homework on your rent to renters to avoid any surprises later on.

Don’t forget about safety checks like gas and electrical inspections, and make sure you’re part of property redress schemes. To protect yourself from potential issues, be clear about responsibilities and safeguards in the lease agreement. If problems crop up, deal with any damages at the end of the term and follow legal procedures for regaining possession.

Stay informed about any changes in the law, such as the possible removal of Section 21, which could affect your rights and duties. Getting legal advice and checking out the reputation of your rent to renters can help you steer clear of future problems.

Focus on these key areas:

- Check compliance requirements for safety checks and property schemes.

- Spell out clear obligations in lease agreements.

- Stay up-to-date on legislative changes impacting landlord rights.

- Get legal advice to ensure everything is done correctly and to protect yourself.

Types of Rent to Rent

When you look into different types of rent to rent, you’ll see a few models that suit various needs and plans.

The Guaranteed Rent Model gives landlords a steady income.

The Lease Option Agreement offers flexibility for potential property purchase.

The Corporate Subletting Strategy works well for companies seeking efficient employee housing.

Guaranteed Rent Model

In a guaranteed rent model, you basically rent out your property to a company that guarantees you a fixed rental income every month, even if your property is empty. This means you don’t have to stress about finding tenants or dealing with late payments – the company takes care of all that for you.

It’s a pretty sweet deal because:

- You get a set amount of income coming in each month without having to do much work.

- The company handles the risks of having your property sit empty or dealing with tenants who don’t pay rent.

- You can sit back and relax while the company takes care of finding tenants, collecting rent, and looking after the property.

- You don’t have to worry about whether your property meets all the legal requirements – the company makes sure everything is up to standard.

Lease Option Agreement

If you’re not quite ready to buy a home but want the option to do so in the future, a lease option agreement might be just what you need. This arrangement allows tenants to rent a property with the possibility of owning it later on.

How? Well, you pay a fee upfront that gives you the right to purchase the property at a set price down the road. It’s like having a test drive before committing to homeownership.

What’s cool about this setup is that you can also sublet the property. This means you can rent it out to others and make some extra cash while you decide if buying is the right move for you. It’s a win-win situation for tenants who get to explore property management and investment without the immediate pressure of a mortgage.

Now, landlords also stand to benefit from this arrangement. They get a steady stream of rental income and the potential for a higher sale price in the future.

It’s a partnership where both parties have a common goal and can work together towards a successful outcome.

Corporate Subletting Strategy

Corporate subletting strategies in the rent-to-rent market can be a lucrative opportunity for investors and property managers. By teaming up with corporations, you can secure long-term tenants and ensure a steady flow of rental income. This partnership is especially valuable in today’s market, where the demand for short-term corporate housing is on the rise.

When you jump into corporate subletting, you’ll work closely with local authorities, property management companies, and individual investors. It’s crucial to clearly define everyone’s responsibilities in the lease agreements to avoid any confusion. This way, all parties are on the same page about what they need to do.

Here are some key things to keep in mind:

- Corporate Partnerships: Build strong connections with businesses to lock in reliable tenants.

- Market Trends: Stay informed about the latest market needs to tailor your offerings accordingly.

- Legal Compliance: Ensure that all agreements comply with local laws and regulations.

- Profit Potential: Take the time to analyse different rent-to-rent models to understand the potential profit margins.

Responsibilities and Repairs

Responsibilities and repairs are key components of a rent to rent agreement. By clearly outlining who’s responsible for what, both parties can avoid misunderstandings and keep the property in good shape.

When you’re renting to rent, it’s important to know what repairs you’re in charge of and which ones fall under the property owner’s responsibility. This clarity helps ensure that the property is well-maintained and everyone is on the same page.

To kick things off on the right foot, it’s a good idea to create a schedule of condition when you start the tenancy. This document will detail the state of the property at the beginning of the agreement and hold both parties accountable. By noting any existing issues upfront, you can avoid disputes down the line and establish clear expectations for future repairs.

Here’s a breakdown of who typically handles what:

- General Property Maintenance: This is usually the responsibility of the rent to renter. Keeping the property clean and well-maintained falls under this category.

- Structural Repairs: The property owner is typically in charge of structural repairs. This includes any issues with the building itself.

- Appliance Repairs: If specified in the agreement, the rent to renter may be responsible for repairing appliances.

- Major System Repairs: The property owner usually takes care of major repairs to systems like heating or plumbing.

Key Contract Points

Now that you’ve got a handle on the responsibilities and repairs, let’s dive into the key contract points that are essential for a solid rent to rent agreement. These points serve as the foundation for a smooth and legally compliant arrangement between you, the property owner, and the tenants. By covering these aspects, you’ll set yourself up for a successful rent to rent partnership.

First up, let’s talk about a Risk Assessment. It’s crucial to thoroughly assess any potential risks like property conditions and tenant behaviour. This step helps to anticipate and address any issues that may arise down the line.

Next on the list is Financial Implications. Be crystal clear about who’s responsible for what financially. This includes rent payments, deposits, and any fees involved. Transparency in this area can prevent disagreements later on.

Don’t forget to include a detailed Schedule of Condition in the contract. This document lays out the property’s condition at the start and end of the lease, ensuring everyone is on the same page about its state.

Lastly, it’s a smart move to have a Solicitor Review the rent to rent agreement. This legal oversight ensures that all parties are protected and that the agreement aligns with local laws.

Permissions and Obligations

Before you jump into your rent to rent business, it’s crucial to get all the necessary permissions and understand what you need to do to keep everything running smoothly.

First off, you have to get permission from the landlord. If you’re a leaseholder, the freeholder has to agree to let you sublet the property. Also, your mortgage lender needs to give the green light to make sure you’re following the rules of your loan. If you skip these steps, you could end up facing some serious legal problems later on.

Next, think about the rights of your tenants. As the person renting out the property, it’s your responsibility to make sure that all gas and electrical safety checks are done and that the property meets all safety standards. This not only protects your tenants but also makes sure you’re following the law.

Having the right insurance is also really important. It’s up to you to get the right insurance coverage to protect against any potential damages or liabilities. Without it, you could be taking on some big financial risks.

It’s also a good idea to keep things clear legally by excluding the property from the Landlord and Tenant Act in your agreements.

Lastly, being part of property redress schemes shows that you’re committed to high standards and provides a safety net for your tenants. Getting these permissions and obligations sorted out sets you up for success in your rent to rent business.

Insurance and Deposits

Securing the right insurance and handling deposits properly are crucial steps in protecting your rent to rent business from risks and liabilities. As the rent to renter, it’s your responsibility to get the right insurance coverage to protect the property and cover any potential liabilities. This means meeting specific insurance requirements for the property and tenants.

When it comes to deposits, you need to be diligent. You must follow deposit protection schemes by safeguarding tenants’ deposits and clearly explaining refund procedures.

Here are some important things to remember:

- Deposit protection: Make sure all tenant deposits are placed in a government-approved protection scheme to avoid legal troubles and build trust.

- Insurance requirements: Get comprehensive insurance that covers property damage, landlord liabilities, and risks related to tenants.

- Compliance checks: Regularly check gas and electrical safety to meet legal standards and ensure a safe living environment.

- Liability coverage: Ensure your insurance includes liability coverage to safeguard against potential claims from tenants or other parties.

Evaluating Rent to Rent Opportunities

When you’re checking out rent-to-rent opportunities, it’s crucial to really dig into the property’s potential and rental income to ensure it’s a good deal. Start by crunching the numbers and doing some market research. Look at the local rental market to see what the demand and prices are like, and make sure the property can bring in enough money to cover costs and turn a profit.

You’ll also need to see if the property can be used as an HMO (House in Multiple Occupation) or for serviced accommodation, following the rules set by your mortgage and insurance. This step is super important for staying compliant and managing risks. If the property is already set up as an HMO, it might make things easier with mortgages and insurance, smoothing out your investment journey.

Get a solicitor to help you draw up or review your contracts, especially if you’re thinking about special deals like rent-to-rent with an option to buy. Having solid contracts, like commercial leases and management agreements, can make your life easier and protect your interests.

And don’t forget to think about your exit strategies. It’s smart to have a plan in place for when things don’t go as expected. Being prepared for different scenarios will give you peace of mind and help you feel secure in your investment decisions.

Conclusion

Rent to rent agreements are a popular strategy in the property market. It’s interesting to note that nearly 20% of UK landlords see rent to rent as a good option.

To navigate this model successfully, it’s essential to know your legal responsibilities, obligations for repairs, and key contract points. Always ensure you have the required permissions and appropriate insurance to safeguard your interests.

By carefully assessing opportunities, you can make well-informed and profitable decisions.

- Rent-to-Rent Schemes: Hidden Dangers Lurk - July 6, 2024

- How to Sell Your House Fast in Kent - July 5, 2024

- 7 Tips to Sell Your House Fast - July 4, 2024