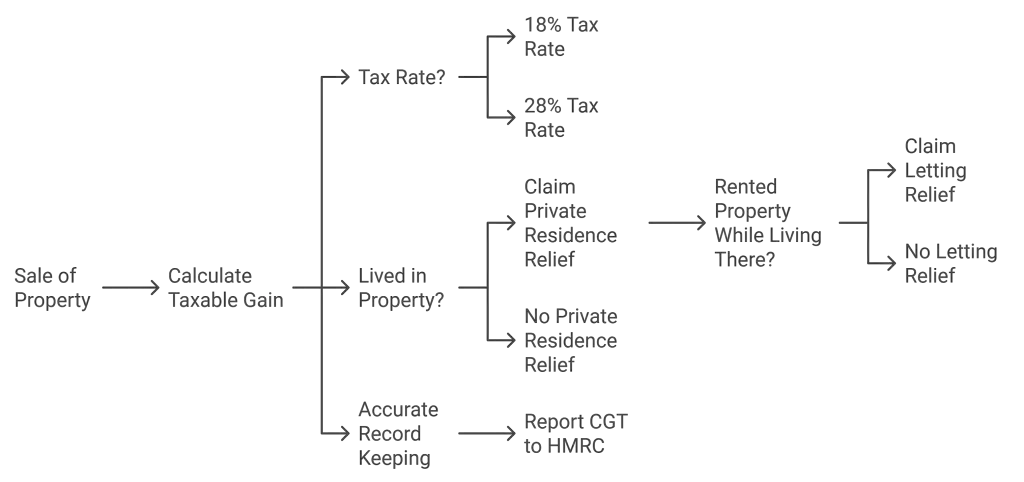

When you sell tenanted property, navigating Capital Gains Tax (CGT) is crucial. Start by calculating your taxable gain—subtract your purchase price and any allowable costs from the sale price. Remember, basic rate taxpayers pay 18%, while higher-rate ones face 28%. You might qualify for Private Residence Relief or Letting Relief to reduce your gain. Document all expenses and occupancy periods for clarity. Reporting to HMRC should be done within 60 days of the sale. And hey, keeping organized records can save you some headaches later. There’s plenty more to uncover about optimizing your tax position, so stick around!

Understanding Capital Gains Tax

Understanding Capital Gains Tax (CGT) is crucial for anyone selling tenanted properties. When you decide to sell, you’ll need to grasp the tax implications of your property’s increased value. CGT applies to the profits made on the sale, which means you’ll subtract the property’s initial purchase price and allowable costs—like estate agent fees—from the final sale price to calculate your taxable gain.

As a basic rate taxpayer, you could face an 18% tax, while higher-rate taxpayers might see a 28% tax on residential property gains. If you’ve lived in the property, periods of residence can help reduce your taxable gain, but remember, only those times contribute to Private Residence Relief.

And don’t forget about Letting Relief! If you rented the property while living there, this could also reduce your chargeable gain.

Keep accurate records to support your calculations and any relief claims, as you’ll need to report your CGT liability to HMRC within 60 days of the sale.

Exemptions for Tenanted Properties

When you’re selling a tenanted property, it’s important to know the exemptions that might apply to you.

For instance, if the property was your primary residence at any point, you could benefit from Private Residence Relief on any gains made during that time.

Plus, if you’d a dependent relative living there, you might find additional relief options available, so let’s explore these possibilities!

Tax Relief Eligibility Criteria

Navigating the complexities of tax relief eligibility can feel overwhelming, especially for owners of tenanted properties. To help you grasp the eligibility requirements, here are three key points to keep in mind:

- Private Residence Relief: This relief applies only to the part of your property that served as your primary residence. If you’ve rented it out, you’ll need to calculate the exact portion that qualifies.

- Letting Relief: You can claim this relief if you rented the property while living there. It offers a reduction in chargeable gains, capped at £40,000 or the amount of Private Residence Relief, whichever is lower.

- Last Nine Months: The final nine months of ownership can qualify for Private Residence Relief, even if you didn’t live there. This means you get a little extra breathing room when selling.

Understanding these aspects can smoothen your path to navigating capital gains tax.

Remember, you’re not alone in this journey. With the right information, you can maximize your tax relief and add value to your home.

Embrace the process—it’s a step toward securing your financial future!

Exemptions for Dependent Relatives

If you’ve been renting out your property but also had a dependent relative living there, you might be in for some good news regarding Capital Gains Tax exemptions. The dependent relative benefits can significantly lighten your tax load when it’s time to sell.

If your property served as their main residence during your ownership, and they lived there for at least part of that time, you could qualify for a full exemption on Capital Gains Tax, even if you rented it out at other times.

To make this work for you, ensure that you have the proper residency documentation. This could include official mail, utility bills, or any legal documents that link your dependent relative to the property. Such proof is essential when you’re reporting Capital Gains Tax upon selling.

This exemption is especially helpful for properties that have appreciated in value while rented out, allowing you to retain more of your hard-earned equity.

Special Provisions for Disabilities

Understanding the special provisions for disabilities can significantly impact your Capital Gains Tax situation, especially if you’ve rented out a property.

These disability provisions are designed to provide relief for individuals who’ve had to relocate due to their circumstances. Here’s what you need to know:

- Occupancy Duration: The exemption applies regardless of how long the disabled person occupied the property, as long as it was their main residence at some point.

- Private Residence Relief: Full Private Residence Relief may apply for the last 36 months of ownership, even if you weren’t living there during that time.

- Accurate Records: Keeping detailed occupancy records is essential to determine eligibility for these exemptions and ensure accurate CGT calculations.

Calculating Your Taxable Gain

When selling a tenanted property, it’s crucial to accurately calculate your taxable gain to avoid any surprises come tax time. Start by determining your overall gain: subtract the original purchase price from the sale price. This forms the basis of your taxable gain calculation.

But don’t stop there! You can significantly reduce this amount by considering deductible costs like estate agent fees and legal fees.

Also, keep in mind the impact of any capital improvements you’ve made. Upgrading the kitchen or adding a conservatory can enhance your property’s value and lower your taxable gain.

If the property was your primary residence at any point, you might qualify for Private Residence Relief, allowing you to exempt part of your gain from tax.

If you rented the property while living there, you might also benefit from Letting Relief, which further reduces your taxable gain.

To maximize these reliefs, accurate record-keeping is essential. Document all expenses and periods of residence meticulously. This preparation not only helps with your taxable gain calculation but also ensures you’re making the most of what you’ve earned from your investment.

Letting Relief Explained

Letting Relief can significantly ease the burden of Capital Gains Tax for property owners who rent out their homes while still living in them. This relief can be a game-changer in certain letting scenarios, especially if you’ve resided in your property at some point during your ownership duration.

To understand how you can benefit, consider these key points:

- Eligibility: You must have lived in the property as your main residence to qualify for Letting Relief.

- Limitations: The relief amount is capped at the lesser of £40,000 per owner, or the chargeable gain during your letting period.

- Exclusions: If you’ve only rented out the property without ever living in it, you won’t qualify for this relief.

Navigating these rules can feel daunting, but knowing your rights can help you maximize your tax savings.

Remember, changes from April 2020 have tightened the availability of Letting Relief, so staying informed is crucial.

Reporting and Payment Obligations

Navigating the reporting and payment obligations for Capital Gains Tax (CGT) can feel overwhelming, but it’s essential to get it right to avoid penalties.

When you sell your tenanted property, you must report any gains to HMRC within 60 days, regardless of whether tenants occupied the property. This can seem daunting, but breaking it down helps.

You’ll need to submit a Capital Gains Tax on UK property return, detailing the profit from the sale. This includes calculating your gain while considering allowable costs, like legal and estate agent fees, which can reduce your taxable amount.

Keeping accurate records of the sale price, purchase price, and any deductible expenses is crucial. Imagine having all that info neatly organized—it makes the process smoother!

Strategies to Minimize Tax Liability

Minimizing your Capital Gains Tax liability is crucial for maximizing profits from your property sale. With smart tax planning, you can navigate the complexities of selling tenanted property and keep more of your hard-earned money.

Here are three effective strategies to consider:

- Utilize Your Tax-Free Allowance: For the 2023/24 tax year, you can benefit from an annual tax-free allowance of £6,000. Use this to reduce your overall taxable gain when selling.

- Timing is Everything: If possible, time your sale to span across two tax years. This allows you to leverage two annual allowances, providing greater tax relief.

- Claim Private Residence Relief: If the property was your primary residence at any point, apply for this relief. It can significantly lower your chargeable gain, keeping your profits intact.

Remember to document any capital improvements you’ve made, as these can also be deducted from the sale price.

Lastly, consider transferring ownership to a spouse or civil partner; this can effectively double your tax-free allowance.

Impact of Tenancy Agreements

When you’re selling a tenanted property, it’s essential to understand how the existing tenancy agreement impacts the sale process. Your tenant’s rights remain intact, meaning they won’t have to vacate immediately. This can complicate things, but it also opens doors to a wider pool of buyers, especially investors seeking immediate rental income.

A well-structured sales process can streamline this situation, as fast sales solutions provide specialized services to manage tenant communications effectively.

When arranging property viewings, you’ll need to respect your tenant’s right to quiet enjoyment. This means you may have to schedule visits around their availability, which can be a bit tricky.

It’s a good idea to communicate openly with your tenant about the process—after all, a happy tenant can lead to a smoother sale and better offers.

The terms of the tenancy agreement, including any break clauses, can influence your timeline and negotiation strategies. If your tenant is on a long-term lease, this could affect how quickly you can close the sale.

However, a well-informed buyer may appreciate the steady income stream from an existing tenant, potentially raising your sale price.

Seeking Professional Financial Advice

When it comes to navigating Capital Gains Tax, getting professional financial advice can really pay off.

A qualified adviser can help you create tailored tax strategies that not only keep you compliant but also ensure you’re making the most of available reliefs.

Plus, staying updated on the latest tax regulations can save you from potential penalties, so why not invest in expert guidance?

Benefits of Expert Guidance

Navigating the complexities of Capital Gains Tax can be daunting, but seeking expert guidance can make a significant difference in your financial outcomes.

With the right financial adviser by your side, you’ll not only feel more confident but also potentially save a substantial amount on taxes. Here are three key benefits of expert guidance:

- Tailored Strategies: A qualified professional can develop personalized financial planning strategies, ensuring you minimize your CGT liabilities effectively.

- Identify Deductions: They’ll help you pinpoint deductible costs like legal fees and estate agent commissions, which can significantly lower your taxable gains.

- Maximize Reliefs: Understanding the implications of Private Residence Relief and Letting Relief is crucial, and an expert can ensure you take full advantage of these options.

Additionally, a financial expert can assist you in timing your sale to optimize annual tax allowances, potentially allowing you to benefit from multiple years’ exemptions.

Staying updated with changing tax laws through professional guidance keeps you compliant with reporting obligations, helping you avoid those pesky penalties.

Investing in expert advice is a smart move that pays off in the long run!

Tailored Tax Strategies

How can you ensure that you’re making the most of your financial decisions regarding Capital Gains Tax? Seeking professional financial advice is key to developing tailored tax strategies that fit your unique situation.

A qualified financial adviser can help you navigate tax planning effectively, ensuring you minimize your Capital Gains Tax liabilities when selling tenanted properties.

These experts can offer insights into letting relief, which might apply if you rented out the property while living there. This could significantly reduce your taxable gains.

Additionally, they can help you strategize the timing of your property sales, allowing you to maximize annual tax-free allowances and potentially defer CGT across multiple tax years.

It’s also essential to document any changes in residence or ownership, as this can enhance private residence relief.

Not to mention, engaging with financial professionals ensures you accurately account for allowable costs, like agent fees and improvement expenses.

Ultimately, working with a financial adviser not only maximizes your deductions but also reinforces your investment strategies.

Staying Updated on Regulations

Staying informed about changes in Capital Gains Tax regulations can save you from costly surprises down the line. Tax laws aren’t static; they evolve, and so should your understanding of them. Engaging a qualified financial adviser can make all the difference when navigating these complexities, especially if you’re selling tenanted properties.

Here’s how you can stay updated:

- Regularly review HMRC resources: Check guides and updates to ensure you comply with your reporting and payment obligations.

- Subscribe to financial advice platforms: These services can deliver timely tax updates straight to your inbox, keeping you in the loop about regulatory changes.

- Maintain a relationship with a tax professional: They can help identify potential exemptions and reliefs, maximizing your tax efficiency.

Conclusion

Navigating capital gains tax when selling your tenanted property might feel like solving a puzzle, but it doesn’t have to be daunting. By understanding the exemptions and strategies at your disposal, you can turn this challenge into an opportunity for financial growth. Remember, every property has potential—think of it as a treasure chest waiting to be unlocked. So, keep your chin up, gather your resources, and consider professional advice to help you sail smoothly through the process.

- Navigating Capital Gains Tax When Selling Tenanted Property - October 24, 2024

- Understanding Capital Gains Relief for Tenanted Property - October 24, 2024

- Is Now the Perfect Time to Invest in Rental Property? - October 1, 2024