In the UK, changes to the way that digital taxes are collected are being introduced in 2026. You might have heard the intention is to go digital, but what does tax going digital mean?

Tax going digital means that the HMRC (the UK’s Inland Revenue) is now able to send out their tax returns electronically. This saves them money and also makes it easier for people to file their taxes online.

Taxes have always been an important part of business, and the advent of digital technology has only made them more so.

Making Tax Digital (MTD) is a Government project to modernise the tax system by creating a digital tax journey, starting with how we keep records relating to income and outgoings. It’s something many business owners have naturally moved towards when keeping tax information ready for tax returns.

The new digital tax changes that are being introduced in 2026 will have a big impact on landlords. Landlords will need to use a cloud-based accounting system for their rental properties in order to be compliant with the new rules. These changes could make it harder for landlords to keep track of their finances and make it more difficult to comply with the law.

However, don’t worry, we’ve taken a look into a solution for this upcoming change to ensure landlords don’t get caught out.

Are landlords affected by Making Tax Digital?

Many landlords, like myself, treat property investment and rental as a full-time job, but for a lot of others it’s a side project. As of 2nd February 2022, the government has stated that if you receive property income over £10,000 then you are required to operate via the Making Tax Digital changes.

That works out to just over £800 a month; if you’re making less than that in total the changes won’t impact you (for now!), but that doesn’t mean it isn’t a good idea to get the right systems in place, that way you have the groundwork in place as you grow your property empire.

The changes will affect landlords in a number of ways:

Firstly, they will need to ensure that their rental properties are registered with HMRC so that they can be included in the new online system.

Secondly, they will need to start using a cloud-based accounting system for their rental properties which meets the requirements set out by HMRC.

Finally, landlords should consider how these changes might impact their overall taxation liability and make sure they have adequate provision for this.

How does making tax digital work?

Making tax digital means that all tax payments are done electronically, submitted online via authorised software.

The new digital tax changes being introduced in the UK in 2026 are designed to make it easier for landlords to comply with their tax obligations. The changes will affect how landlords file and pay their taxes, as well as how they keep records of their rental income and expenditure.

Landlords will need to use a new online system to file their taxes, and they will be required to submit quarterly returns instead of annual returns. These changes will simplify the tax process for landlords and make it easier for them to stay compliant with the law.

The specialist software communicates with HMRC digitally using an Application Programming Interface. Basically, the software you use can talk directly to HMRC.

There are a lot of different options available, but a good platform for landlords will do a lot more than submit tax information; it should help you track money in and out, allowing you to keep track of finances relating to properties.

Another benefit of online taxation is that it reduces paperwork burdens for landlords. Instead of filling out multiple forms every year, they can simply submit tax returns online via the software platform.

I would hope that this move to electronic filing will allow for quick turnaround times when requesting refunds or changes to your taxes; the juries out on that one until the system is fully in place.

Landlords who do not already have an accounting system in place will need to put one in place before these changes come into effect.

The good news is that I’ve been looking around for my own solution and there are many cloud-based accounting systems available that can make it easy for landlords to comply with the new requirements.

What do landlords need to do to prepare for these changes?

With the new digital tax changes set to come into effect in 2026, landlords need to start preparing now. The first step is to find a good cloud-based accounting system that will help you keep track of your rental income and expenses.

This will be important because you will need to provide evidence of your rental income and expenses when you file your taxes under the new rules.

You should also talk to your accountant or tax advisor about the changes so that you can make sure you are prepared come tax time.

I’ve been researching my options and so far I like the look of LandlordStudio, which does a lot more than just filing tax returns. It is a web-based software application designed to help landlords manage their properties and tenants.

LandlordStudio allows landlords to track rent payments, expenses, and maintenance requests. It also includes a tenant portal where tenants can pay rent online and submit maintenance requests.

The software can help landlords like us save time and money by streamlining the property management process, giving you and your tenants a central area to manage your relationship, for example you can:

- Track rent payments

- Manage maintenance requests

- Create lease agreements

- Tracking income and expenses

- Share financial information with your accountant

- Manage from mobile

I especially like the mobile app, it means I can access the system on the go, especially useful if I’m with a tenant. Check out how easy it is to set up a new rent collection on your mobile:

Note that in the video you’ll see $ amount; don’t worry this isn’t for America only. I’ve confirmed they are very well established in the UK.

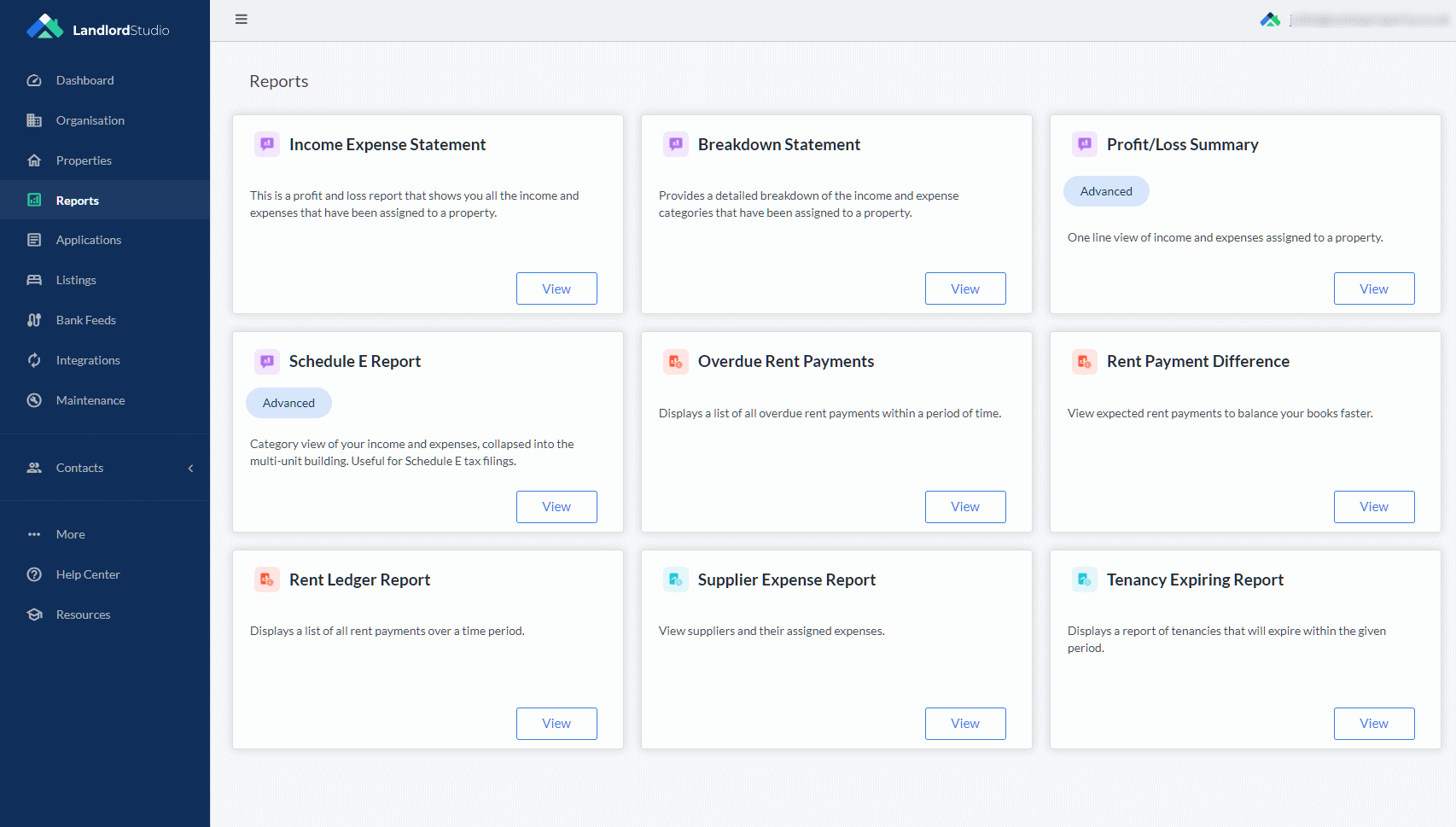

I also like the easy-to-understand reporting options; no more squinting at little rows on a spreadsheet!

Unsure if it’s right for your property business? They’ve got a free 14-day trial letting you fully explore the system. After that, the pricing is very reasonable, scaling depending on your needs. Plans start from £5.99 a month for a single property and limited features, going up to £19.99 a month for all the bells and whistles you could need.

Final thoughts

Although many of us are used to keeping tax records in paper form, the move to digital is a very sensible one.

Landlords should make sure they have MTD-compatible software in place so that they can comply with the new digital tax requirements when they come into effect in 2026.

Take this opportunity to get a really helpful cloud-based system in place, not only to comply with the new requirements when they come into effect in 2026, but also to better manage your property business.

Sources