Now’s a strong time to invest in rental property, driven by a 3.2% annual rise in UK house prices and a recent base rate cut to 5%. These factors enhance affordability and boost ROI prospects, with minimum yields of 5-8% recommended for buy-to-let investments. Mortgage approvals surged by 3.8%, indicating growing lender confidence. Northern Ireland stands out with an impressive 8.6% growth in house prices, suggesting ideal rental market conditions. However, consider regional differences and potential risks. There’s much more to explore regarding market trends and investment strategies that could benefit your decision-making.

Current Market Overview

In today’s rental property market, there’s a noticeable shift driven by various economic indicators. The UK property development sector is set to recover by 2025, aided by improved lending confidence and a rise in dwelling starts.

This rebound signals an opportune moment for you to evaluate diverse property types as potential investments. As of September 2024, house prices rose by 3.2% year-on-year, with Northern Ireland leading at 8.6% growth in Q3 2024, highlighting regional disparities that can inform your investment strategies.

Achieving a minimum yield of 5-8% is advisable for buy-to-let investments, making this an attractive time to enter the market. The average price of terraced houses increased by 3.5%, reflecting strong demand in this segment.

This trend suggests that focusing on specific property types, like terraced houses, could yield favorable returns. Meanwhile, enhanced consumer confidence and competitive mortgage deals make the rental property market increasingly attractive for investors like you.

Economic Indicators Impacting Investment

As you consider investing in rental properties, current market trends and interest rate movements are significant factors.

The recent 3.2% growth in UK house prices and a drop in the Bank of England’s base rate to 5% signal a more favorable climate for property investment.

Additionally, with a good ROI threshold of at least 5% for property investments, now may be an opportune moment to enter the market as the rise in mortgage approvals suggests an increasing consumer confidence, which could further drive demand in the rental market.

High ROI opportunities can lead to substantial profits for savvy investors.

Current Market Trends

Recent data highlights a favorable environment for rental property investment, driven by key economic indicators. The UK housing market’s annual growth of 3.2% in house prices as of September 2024 signals a recovery that could benefit you as a rental property investor.

Understanding your financial foundations is essential at this juncture, as economic stabilization has also boosted consumer confidence, reflected in a 3.8% increase in mortgage approvals in August 2024. This uptick enhances the attractiveness of the rental market, making it a viable option for various investment strategies.

Moreover, the anticipated government initiatives aimed at bolstering construction and planning are expected to create more rental opportunities in emerging markets. With rent values demonstrating sustained growth, investing in real estate is increasingly seen as a reliable income source.

The recent base rate cut to 5% in August 2024 further reduces finance costs, making it an opportune moment for you to explore rental property investments.

As you consider entering this market, pay close attention to these trends. They not only reflect current conditions but also suggest a strategic alignment with your investment goals in the evolving landscape of rental properties.

Interest Rate Influence

Interest rates play an essential role in shaping the landscape of rental property investments, and current trends indicate a considerable shift. The recent August Base Rate cut to 5% has remarkably reduced finance costs, enhancing borrowing affordability for potential investors. This adjustment allows you to secure more favorable financing terms, making it an opportune moment to contemplate rental property investments.

Moreover, anticipated further rate cuts could stimulate consumer demand, potentially boosting rental property values and returns. The increase in mortgage approvals by 3.8% in August signals growing confidence among lenders and investors in the rental market.

With economic stabilization and improved consumer sentiment, demand for rental properties is gaining momentum, especially in areas where house prices are on the rise.

These signs of resilience in the housing market, coupled with annual growth rates in house prices, suggest that investing in rental properties could yield favorable returns. As you evaluate your investment strategy, pay close attention to interest rate adjustments, as they greatly impact your borrowing costs and overall investment viability.

Now may indeed be the perfect time to immerse yourself in the rental property market.

Benefits of Rental Property Investment

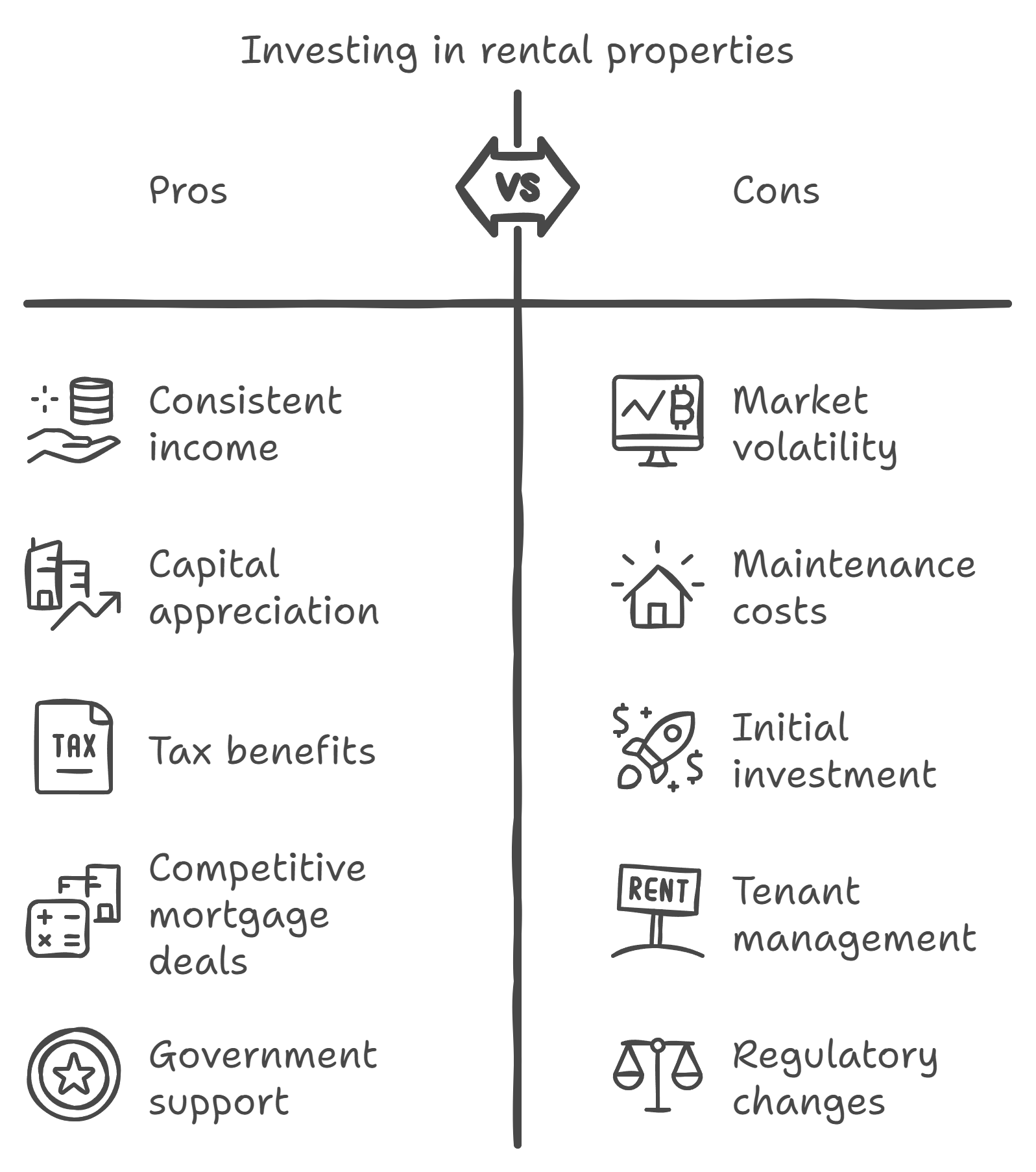

Investing in rental properties offers a compelling opportunity for generating consistent income and building wealth over time. The UK’s rental values are on the rise, indicating a steady income stream for investors. With a 3.2% year-on-year increase in house prices as of September 2024, the property market displays resilience, making it an attractive option for rental investments.

Furthermore, government initiatives aimed at accelerating home delivery and planning reforms are likely to enhance the rental market, presenting additional investment opportunities in the coming years. As property values grow, you can also benefit from capital appreciation, with the average price of flats rising by 15% since Q1 2020.

From a financial perspective, rental properties come with significant tax benefits. You can often deduct mortgage interest, property management fees, and maintenance costs, optimizing your returns.

Additionally, as lenders offer more competitive mortgage deals due to improved consumer confidence, acquiring rental properties becomes more accessible. This combination of consistent income, potential appreciation, and favourable tax treatment positions rental property investment as a strategic choice for wealth-building in today’s market.

Rising House Prices Explained

There’s no denying that the current rise in UK house prices is a significant trend worth understanding. In September 2024, house prices experienced a year-on-year increase of 3.2%, the fastest growth rate since November 2022. Importantly, terraced houses led the charge with a 3.5% rise, while semi-detached homes and flats followed with increases of 2.8% and 2.7%, respectively.

This upward trend is largely fueled by rising demand, particularly in Northern Ireland, where prices surged by 8.6% in Q3 2024. Scotland and Northern England also showed strong growth, with increases of 4.3% and 3.1%.

Despite previous declines in dwelling starts and lending, the property market is showing signs of recovery, thanks to improved consumer confidence and competitive mortgage deals.

The anticipated price increase by year-end suggests a move toward price stability, which is essential for long-term investors. Government initiatives aimed at enhancing construction and planning are further supporting this stabilization, making it vital for you to evaluate these dynamics when assessing rental property investments.

Understanding these factors can help you make informed decisions in a fluctuating market.

Government Initiatives and Support

Government initiatives play a crucial role in shaping the landscape of the rental property market. The new Labour government’s commitment to deliver 1.5 million homes is a significant step towards addressing housing shortages. By expediting the planning system, these housing policies are designed to enhance the efficiency of home delivery, which will positively impact the rental property sector.

Moreover, recent economic indicators, such as the August Base Rate cut to 5%, are expected to lower financing costs. This reduction encourages you, as an investor, to explore rental properties with decreased borrowing expenses.

Coupled with government incentives aimed at boosting consumer demand and confidence, the overall environment for rental property investment appears favorable.

Additionally, the enhanced collaboration among financial institutions, driven by favorable government policies, is likely to create more competitive lending options for you as a prospective investor.

These factors combined suggest that now may be an opportune moment to invest in rental properties. By understanding and leveraging these government initiatives, you can position yourself to capitalize on the evolving rental market landscape.

Regional Market Insights

When evaluating regional market insights, you’ll notice significant variations in house price trends across the UK.

For instance, Northern Ireland’s impressive 8.6% growth highlights a strong rental market potential, while East Anglia’s decline raises concerns.

Regional Price Trends

Recent data reveals significant regional price trends across the UK, highlighting varying levels of demand and growth potential in the rental property market.

Northern Ireland trends show an impressive 8.6% increase in house prices during Q3 2024, indicating strong demand in that market. This growth positions Northern Ireland as a compelling option for investors.

Similarly, Scotland has demonstrated notable growth, with an annual rate accelerating to 4.3% in September 2024, up from just 1.4% in the previous quarter, suggesting a robust recovery.

The North West of England showcases resilience with a 5.0% price increase, signaling stability within property values compared to other regions.

However, not all areas are experiencing growth. East Anglia reported a year-on-year decline of 0.8%, reflecting regional disparities that potential investors should consider when evaluating opportunities.

Rental Demand Analysis

Across various regions, rental demand is showing robust growth, particularly in Northern Ireland, where the rental market is thriving alongside an impressive 8.6% increase in house prices during Q3 2024.

This rising demand reflects shifting tenant preferences, with many seeking rental properties that offer value and convenience.

Scotland also demonstrates notable growth, evidenced by a 4.3% rise in annual house prices, indicating a strengthening market for rental investments.

The North West of England, with a 5.0% increase in property prices, further highlights promising rental opportunities.

Terraced houses have emerged as a particularly appealing option, experiencing a 3.5% price hike, which aligns with tenant preferences for affordable and spacious living.

This trend suggests that understanding what tenants want can enhance your rental yields.

Investment Opportunities Overview

In evaluating investment opportunities in the UK rental market, several regions stand out due to their strong house price growth and favorable economic conditions. Northern Ireland leads with an impressive 8.6% annual increase in house prices, presenting a compelling case for rental property investors.

Scotland’s 4.3% growth signals a recovering market, while the North West of England shows a solid 5.0% rise, indicating a robust regional market.

To maximize your investment strategies, consider focusing on property types that have demonstrated significant appreciation:

- Northern Ireland: 8.6% annual growth

- Scotland: 4.3% recovery in house prices

- North West England: 5.0% increase

- Terraced houses: 3.5% price rise

- Overall positive growth across most UK regions

These insights suggest a favorable environment for diversifying your portfolio.

By concentrating on regions with strong price performance and targeting specific property types, you can enhance your rental income potential.

As you navigate the current market landscape, these factors will guide your decisions and help you capitalize on lucrative investment opportunities in the UK rental sector.

Financing Options for Investors

Maneuvering the financing landscape for rental property investments has become considerably more favorable, especially following the August Base Rate cut to 5%. This reduction has led to decreased financing costs, making it an opportune moment for you to explore various financing strategies tailored to your investment preferences.

The rise in mortgage approvals by 3.8% in August reflects increased lender confidence, resulting in a broader array of financing options for potential property investors. You can leverage this trend by comparing different mortgage products, including fixed-rate and adjustable-rate loans, to find the best fit for your investment goals.

Specialist lenders are also anticipating a strong recovery in lending for property development, which could provide you with more choices for financing rental properties.

In addition, upcoming government initiatives aimed at stimulating housing construction may introduce favorable loan programs, enhancing your financing opportunities.

As you evaluate your options, keep an eye on the competitive mortgage deals currently available. Improved consumer confidence in the housing market means that you’re likely to find attractive rates that align with your investor preferences, allowing you to maximize returns on your rental investments.

Risks of Investing in Rentals

Investing in rental properties carries inherent risks, particularly due to market volatility and unexpected maintenance costs.

With construction lending declining and supply tightening, you may face increased competition and fluctuating rental yields.

Additionally, rising repair expenses and economic factors can further strain your profit margins, making it essential to evaluate the financial implications before proceeding.

Market Volatility Concerns

Market volatility poses significant risks for rental property investors, especially in light of recent trends. The decline in lending for property development, which fell by 7.2% in 2023, signals a potential downturn in market sentiment and investor confidence. New dwelling starts have also dropped dramatically, down 19.8% from the previous year, indicating a shrinking supply of rental properties.

Take into account the following factors:

- Economic uncertainties leading to fluctuations in rental prices.

- Decreased investor confidence affecting demand for rental properties.

- Challenges in securing financing for new developments.

- Anticipated further declines in construction lending, projected at 5.2% by year-end.

- Recovery signs in the UK housing market may not stabilize rental investments.

These elements create a precarious environment for rental property investments. While some indicators suggest a potential rebound in the housing market, the ongoing economic factors could introduce more risks.

As you evaluate your investment strategy, it’s vital to reflect on these volatility concerns and how they impact your long-term goals in the rental property sector. Being aware of these risks will better prepare you for the challenges ahead.

Maintenance and Repair Costs

Economic uncertainties and a declining construction landscape can overshadow the profitability of rental properties, particularly when it comes to maintenance and repair costs.

Landlords should budget around 1% of their property’s value annually for upkeep, as common expenses like plumbing and HVAC repairs can range from $150 to $1,500. A significant 30% of landlords face unexpected repair costs exceeding $500, underscoring the necessity for emergency funds.

Implementing preventive maintenance and adhering to maintenance schedules can drastically reduce these long-term costs by up to 50%. Regular property inspections help identify potential issues early, allowing for timely, cost-effective upgrades.

Prioritizing repairs ensures that critical problems are addressed first, reducing the likelihood of larger, unexpected expenses.

Consider utilizing DIY repairs for minor issues, but make sure you select contractors wisely for more complex tasks. Effective budgeting strategies can also help you manage cash flow and allocate resources for the inevitable wear and tear on your property.

Long-Term Vs Short-Term Strategies

When pondering rental property strategies, understanding the distinction between long-term and short-term approaches is essential. Long-term rental strategies offer stability, with an average UK rental yield of around 4-6%, providing consistent cash flow.

In contrast, short-term rental strategies can yield considerably higher returns, with some properties generating 10-15% gross rental yield, yet they come with short-term challenges, such as increased management and maintenance responsibilities.

Here’s a breakdown to ponder:

- Long-term benefits: Stable income and less tenant turnover

- Short-term potential: Higher income with vacation rentals or Airbnb

- Market growth: 20% increase in rental inquiries post-pandemic

- Regional variations: Areas like Northern Ireland show an 8.6% price increase

- Capital appreciation: 3.2% annual property price increase suggests growth potential

Ultimately, your decision should hinge on your financial goals, risk tolerance, and the time you’re willing to invest in managing your property.

Both strategies have their merits, but aligning them with your objectives is key to maximizing your investment’s potential.

Expert Predictions for 2025

As we look ahead to 2025, experts predict a robust recovery in the UK property development sector, underpinned by improved lending conditions and government initiatives aimed at enhancing home delivery and planning reforms.

Expert insights suggest that the anticipated cut in the Base Rate to around 5% will stimulate consumer demand, making it an opportune time for you to invest in rental properties.

Market forecasts indicate that the UK government has set a target of constructing 1.5 million homes, which will likely increase the availability of new-build properties.

This surge presents enhanced opportunities for buy-to-let investors like you. With overall positive market sentiment and an expected rise in housing demand, rental property investments could yield strong returns in the coming years.

As confidence returns to the housing market, you can benefit from competitive mortgage deals and increased consumer interest in rental properties.

This landscape suggests that positioning yourself in the rental market now could be strategically advantageous.

Frequently Asked Questions

What Types of Properties Are Best for Rental Investment?

When considering rental investments, single family homes often provide stability and long-term appreciation, while multi family units can maximize cash flow and attract diverse tenants. Analyzing local market trends helps you make informed decisions.

How Should I Choose a Location for My Rental Property?

To choose a location for your rental property, analyze rental market trends and evaluate neighborhood amenities. Focus on areas with rising demand, strong economic indicators, and development plans to enhance long-term investment potential.

What Are the Tax Implications of Rental Property Investment?

When considering rental property investment, understand tax implications. You’ll benefit from tax deductions on expenses and depreciation benefits, greatly lowering your taxable income while maximizing your investment’s long-term profitability and growth potential.

How Can I Effectively Manage My Rental Property?

To effectively manage your rental property, prioritize tenant screening to guarantee reliable occupants, and implement regular property maintenance checks. This approach minimizes costly repairs, enhances tenant satisfaction, and ultimately reduces vacancy rates, safeguarding your investment’s value.

What Are Common Pitfalls for First-Time Rental Property Investors?

As a first-time investor, you might overlook financing options and the importance of tenant screening. Failing to analyze ongoing expenses and legal responsibilities can lead to costly mistakes that negatively impact your cash flow and investment success.

Conclusion

As you’ve seen, the current market presents both opportunities and challenges for rental property investment. While rising house prices and supportive government initiatives may favor investors, it’s essential to weigh the associated risks and financing options carefully. By considering long-term versus short-term strategies, you can align your investment goals with market trends. Ultimately, staying informed and adapting to economic indicators will help you make a more strategic decision about whether now’s the right time to invest.

- Finding Tenanted Properties for Sale in Your Area - October 26, 2024

- Understanding Your Rights When Selling Tenanted Property - October 26, 2024

- Is Now the Perfect Time to Invest in Rental Property? - October 25, 2024