When it comes to investing, there are many options to choose from, shares and property being two of the most popular choices. Both are considered worthwhile investment options, providing you with the potential to earn profits through capital appreciation and rental income. So, which is better between them?

It is better to invest in property If you’re looking for stable and predictable income. On the other hand, invest in shares if you want higher returns in the long term. Shares are generally volatile, while property offers more stability at a slower growth rate.

Read on for detailed explanations of the pros and cons of investing in shares or property to help you make the most informed decision.

Shares vs Property: Which One Should You Invest In?

Deciding where to invest your hard earned money can be a difficult decision. Understanding the risks and benefits of investing in shares or property can help you make that decision.

You should invest in shares if you are willing to take more risk and property if you are looking for a stable income stream. However, you can invest in both assets to get a taste of both worlds. This gives you the potential to earn both capital appreciation and rental income.

However, if you can only invest in one or the other, it’s essential to understand the critical differences between shares and property to make an informed decision. Besides, the choice between shares and property is not as clear-cut as it seems – each has its own set of benefits and risks.

The Benefits and Risks of Investing in Shares

A share represents a small fraction of a company’s ownership, and can be bought and sold on public markets. Investing in shares can provide an individual with opportunities to make money through capital gains and dividends paid out by the company. However, there are also risks associated with investing in shares, including the possibility of losing one’s entire investment.

Therefore, it’s crucial to understand these benefits and risks to only invest an amount that you’re comfortable losing.

What Are the Benefits of Investing in Shares?

Here are a few benefits of investing in shares:

- You can start with a small investment.

- Shares provide you with a regular income.

- Shares are liquid – you can sell them at any time.

- Shares offer you protection against inflation.

- You can buy shares in companies worldwide.

- Gain benefits via stocks and shares ISA.

Here’s a rundown of these benefits:

You Can Start With a Small Investment

Many people believe that you need a large amount of money to start investing in shares, but this is not true. You can start with a small investment and gradually increase your portfolio as your earnings allow.

For example, if you wanted to buy shares in a company trading at £100 per share, you could purchase 5 shares for a total investment of £500. If the company’s share price rose to £120 per share after some time, your 5 shares would be worth £600 – a 20% return on your investment.

Shares Provide You With a Regular Income

Another notable benefit of investing in shares is the potential to earn regular income. When you purchase shares in a company, you become a partial owner of that business.

As an owner, you are entitled to a share of the company’s profits. These profits can be paid out to shareholders in the form of dividends. Dividends are typically paid out every quarter, which means that you can receive a regular income from your shares.

In addition, shares can also appreciate over time. This means that you may be able to sell your shares for more than you paid for them, providing you with a capital gain. Therefore, investing in shares is an effective way to generate a regular income and build your wealth over time.

Shares Are Liquid – You Can Sell Them at Any Time

Liquidity is another primary benefit of shares. This means that you can cash in your investment quickly if you need to, or sell just a few shares to raise some extra cash.

Shares are also relatively easy to buy and sell, and there is a lot of information available about different companies. This makes them a good investment for people who want to be actively involved in their finances.

Shares Offer You Protection Against Inflation

Inflation is a significant concern for any investor, as it can erode the purchasing power of your investment portfolio. However, you can protect yourself against it by investing in shares with the potential for capital growth, outpacing inflation over the long term.

In addition, shares tend to provide a higher income level than other asset classes such as property, cash, and bonds. This means that you can reinvest your dividends to buy even more shares, which will help to further protect your portfolio from the effects of inflation.

You Can Buy Shares in Companies Worldwide

A few decades ago, UK investors were limited in their ability to invest in foreign companies. For many years, the only way to do so was to physically buy shares in the company, which generally involved a lot of paperwork and red tape.

However, thanks to the internet, it is now possible to buy shares in companies worldwide without ever leaving your home. You can do this by opening an account with a broker that offers international trading facilities.

Once you have opened an account, you will be able to buy and sell shares in any publicly traded company, regardless of where it is located. This has opened up a whole new world of investment opportunities for UK investors.

Gain benefits via stocks and shares ISA

A Stocks and Shares ISA (SSISA) is a tax efficient investment vehicle available to UK residents. The SSISA allows investors to save money on income tax by investing their savings in the stock market through a tax free wrapper.

The main benefit of the SSISA is that it offers tax relief on interest earned on investments held inside the wrapper. This means that if you invest £1,000 in an SSISA, then any interest earned on this amount will be exempt from paying Income Tax.

Speak to our expert at AW Wealth Ltd to discuss the benefits of investing in stocks and shares.

What Are the Risks of Investing in Shares?

The risks of investing in shares include the following:

- The company could go bankrupt, resulting in a loss.

- The share price could fall, resulting in a loss.

- You could experience a margin call.

- You could be subject to taxation on your capital gains.

The Company Could Go Bankrupt, Resulting in a Loss

One of the most significant risks of investing in shares is that the company could go bankrupt. This means that it would likely go out of business, and its shareholders would lose their money. This is a relatively rare event, but it can happen.

For example, the company could experience financial problems due to a recession or economic downturn.

The Share Price Could Fall, Resulting in a Loss

Another risk of investing in shares is that the price could fall. This means that you could lose money on your investment if you sell it at a lower price than you paid for it. This is a risk that all investors face, and it is impossible to predict which way the market will go.

However, share prices tend to appreciate over the long term, meaning that you are likely to make a profit if you hold on to your shares.

For more insights into how the stock market works, check out Stock Investing For Beginners: How To Buy Your First Stock And Grow Your Money (available on Amazon.com). The book explains in detail the different types of shares and how to buy them, as well as providing tips on how to grow your money over time.

You Could Experience a Margin Call

Your broker could issue a margin call if your stock’s price falls too much. This means that you would be required to put more money into your account to maintain your position.

If you don’t have the money available, you could be forced to sell your shares at a loss. You should be aware of this risk if you invest in shares.

You Could Be Subject to Taxation on Your Capital Gains

If you sell your shares for more than you paid for them, you will have made a capital gain. This profit will be subject to taxation, reducing your overall return.

However, the amount of tax you pay will depend on your circumstances, so you should speak to a tax advisor if you’re thinking of investing in shares.

The Benefits and Risks of Investing in Property

Investment property is a tangible asset you can use to generate an income through rental payments. It is also possible for the property to appreciate, providing a capital gain for the investor. Like shares, there are risks associated with investing in property, albeit property is considered a safer alternative.

Nonetheless, before choosing between shares and property, it’s best to also look at the pros and cons of this investment. This helps ensure that you make the best decision for your financial future.

What Are the Benefits of Investing in Property?

Here are some benefits of investing in property:

- Property is a tangible asset.

- You can use the property to generate an income.

- Property offers capital appreciation potential.

- The risks are lower than investing in shares.

Here’s a rundown of the benefits of investing in property:

Property Is a Tangible Asset

One benefit of property is it is a tangible asset. When you purchase a house or a piece of land, you have something to show for your investment. You can see it, touch it, and even live in it.

Unlike stocks or bonds, property is not just a paper asset, it has a value. If you need to sell your property quickly, you can usually find a buyer willing to pay fair market value for it.

In addition, the property can appreciate over time, providing you with a nice nest egg for the future. Whether you are looking for a place to call home or an investment that will pay off down the road, property is always worth considering.

You Can Use the Property To Generate an Income

When you purchase a property, there are several ways that you can use it to generate an income. For example, you could rent out the property to tenants or use it as a base for your own business.

Alternatively, you could list the property on Airbnb or another short-term rental platform. If you have a bit of land, you could potentially build on it or sell it to others to build upon.

No matter what approach you take, generating an income from your property can help to offset the cost of ownership and make it more affordable in the long run. With a bit of creativity, you can turn almost any property into a source of revenue.

And remember, any work carried out following the initial investment should increase property prices when it comes to selling.

Property Offers Capital Appreciation Potential

Like other investments, property offers the potential for capital appreciation, which occurs when the asset’s value increases over time. Unlike stocks or bonds, though, property also offers the benefits of stable income and diversification.

Furthermore, with the right property management team in place, real estate can be a relatively hands-off investment. Therefore, it’s a good option for those who want to invest their money but don’t have the time or expertise to manage a stock portfolio.

The Risks Are Lower Than Investing in Shares

Compared to investing in shares, the risks associated with property are much lower. For one, property is a physical asset that can be seen and touched. This makes it less likely to disappear into thin air, as can happen with some stocks.

In addition, the property market is much less volatile than the stock market. This means that property values are less likely to fluctuate wildly up and down, making it a more stable investment choice over a long period of time.

What Are the Risks of Investing in Property?

The risks of investing in property include the following:

- The tenant could default on rent.

- The property could be subject to damage.

- You could experience negative gearing.

- You could be subject to taxation on your capital gains.

The Tenant Could Default on Rent

One of the most significant risks of investing in property for letting purposes is the potential for a tenant to default on rent payments. If this happens, you could lose money, even if you have been faithfully paying your mortgage each month.

Additionally, tenant default could hurt your cash flows and make it difficult to pay off your monthly expenses. As a result, it’s essential to do your research before investing in property and do thorough background checks on any potential tenants.

The Property Could Be Subject to Damage

Another risk of investing in property is the possibility that the property could be damaged, whether by a natural disaster or a careless tenant. If this happens, you could spend a lot of money on repairs and replacements, which could eat into your profits or even cause you to lose money on the investment.

To reduce this risk, it’s crucial to have a good insurance policy in place and be vigilant about monitoring the property for any damage. You should also have a solid plan for dealing with any emergencies that may arise.

You Could Experience Negative Gearing

Investing in property can also be risky because you could end up experiencing negative gearing. This happens when the rent you receive from your tenants is not enough to cover your mortgage payments and other associated costs, such as property taxes and maintenance fees.

If this happens, you could find yourself in a difficult financial situation, as you will be paying out more money each month than you’re bringing in. To avoid this, it’s essential to do your research before investing and ensure that the property you’re buying is affordable, even if the rent payments are not guaranteed.

You Could Be Subject to Taxation on Your Capital Gains

Another risk of investing in property is that you could be subject to taxation on your capital gains. This means that any profits you make from selling the property will be taxed at your marginal rate, which could end up costing you a lot of money.

To reduce your capital gains tax, it’s essential to speak to your accountant about how best to structure your property investment. You may also want to consider holding the property for a more extended period to benefit from the lower tax rates that apply to long-term capital gains.

Shares vs Property: Crucial Factors To Consider

Now that you know the risks of investing in property, it’s essential to weigh these against the risks of investing in shares. Here are some key factors to consider:

- Liquidity: If you want an investment you can convert into cash quickly, go with stocks. If you’re willing to wait a while to get your money back, property is a better choice.

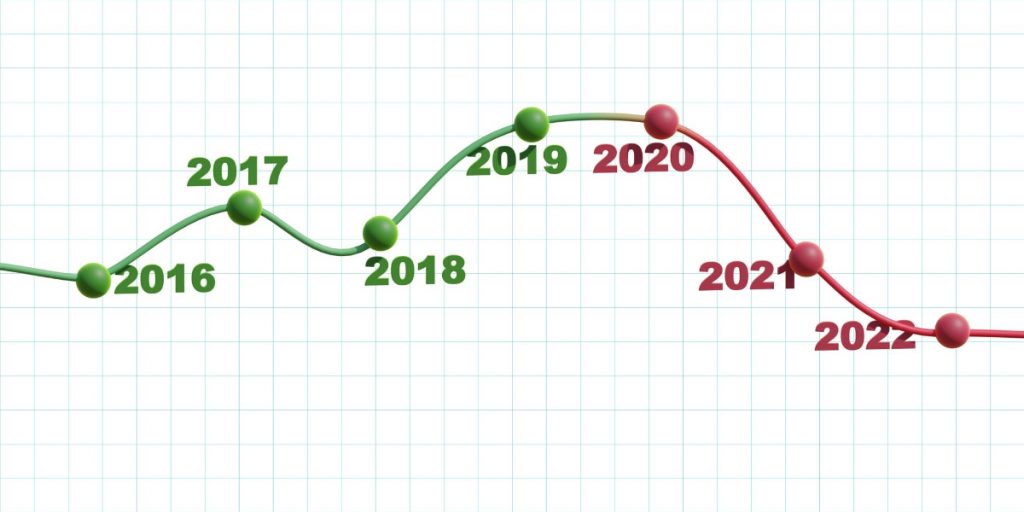

- Volatility: The stock market is more volatile than the property market, meaning that the value of your investment could go up or down quickly. Property values are less likely to fluctuate in this way.

- Asset class: Property is considered a “real” asset, while shares are considered a “financial” asset. This means that property values are more likely to hold steady over time, while the value of shares can go up and down rapidly.

- Stability: If you want a stable investment that will hold its value over time, go with property. Shares are more volatile and could end up losing value.

- Your risk appetite: If you’re willing to take on more risk to potentially earn higher returns, go with shares. If you want a more stable investment, property is the better choice.

- Your disposable income: If you have a lot of money to invest, property may be the better option, after purchasing the property you’ll need cash for renovations. If you don’t have as much money to spare, shares are a more affordable option as they don’t require a large sum to get started and can be added to each month, like a savings account.

Pro Tip: Instead of investing in either or the other, consider diversifying your portfolio by investing in both shares and property. This will reduce your overall risk and give you a better chance of making a profit.

The Bottom Line

So, is it better to invest in shares or property? Ideally, your risk appetite, disposable income, and investment goals should be the deciding factors. For those who don’t fancy the risk of losing their money, property is a safer bet and will stand you in good stead in the long run.

Remember, property is a more stable investment than shares, but it’s also less liquid. Shares are more volatile than property, but they offer the potential for higher returns. Speak to an accountant or financial advisor to find out which option is best for you.

Sources

- Taylor & Francis Online: A Comparative Study on the Investment Value of Residential Property and Stocks

- Wiley: Property vs Shares: Discover Your Knockout Investment Strategy

- JSTOR: Dividend Policy, Growth, and the Valuation of Shares

- ScienceDirect: Inflation Rate

- GOV.UK: Claim Money Back From a Bankrupt Person or Company in Compulsory Liquidation: Detailed Guidance for Creditors

- Forbes: What Is a Margin Call?

- National Bureau of Economic Research: Rethinking How We Score Capital Gains Tax Reform

- ResearchGate: Returns and Risk on Real Estate and Other Investments: More Evidence

- Corporate Finance Institute: Negative Gearing

- Is It Bad To Buy a Flat Instead of Renting? - May 9, 2023

- Is It Bad To Buy a Flat Instead of Renting? - February 20, 2023

- If You Buy a UK House at Auction, When Do You Pay? - February 15, 2023