When starting out in property, the main goal is to find a single location within your budget that you can earn rental income from. As time goes on, you can expand this to a multi-property portfolio. But then what? How do you go on to build a property sourcing business?

Building a successful property sourcing business takes time and cash. It also requires a technical pipeline solution to attract and manage interested parties who wish to sell properties or have you invest in opportunities on their behalf.

By a technical pipeline, I mean a website, marketing emails, customer database, and appointment scheduling. If that sounds a little overwhelming, don’t worry, there is a simple solution called propertypipeline.pro which handles all of this in a single system.

As a property investor I’m sure you’re wondering where you go next and how you start to build a successful property sourcing business. With the right strategy in place, owning rental property can be a great way to generate income and build wealth over time. Once you have established a portfolio you may want to go to the next step and start a sourcing business.

It’s not always easy going from being an amateur investor to running a fully-fledged business. Fortunately, there are some key steps you can take to increase your chances of success.

What are the stages of being a property investor?

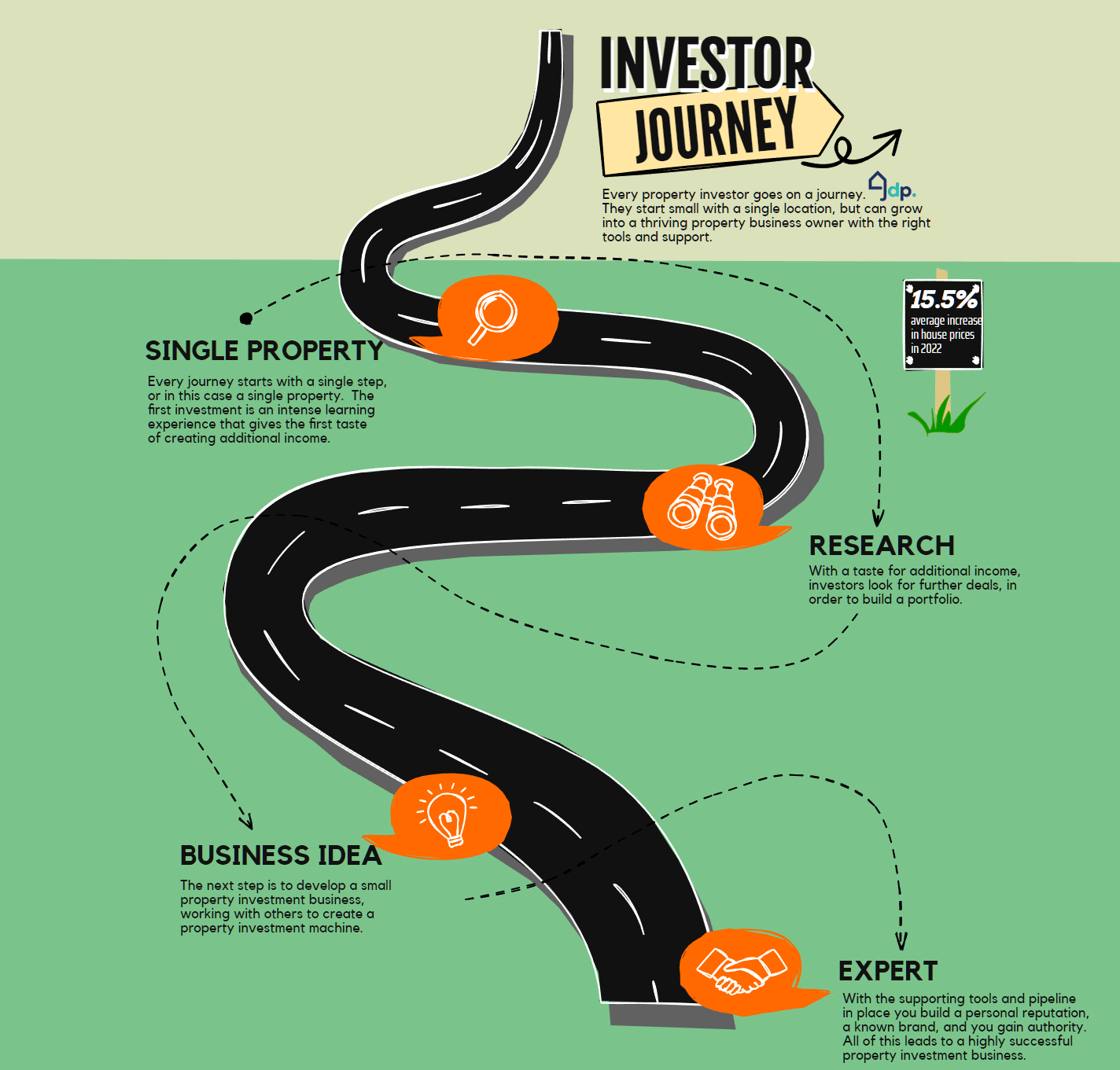

You might think buying a property and renting it out is all there is to being an investor, but in fact, there are several distinct stages.

Stage 1: Getting started. In the beginning, the majority of want-to-be investors have full-time jobs and are looking for a way to maximise their savings. This initial stage sees you purchasing your first property, building a power team, and learning how to be a landlord. It’s also the stage that gives you a taste of earning income through property.

Stage 2: Expansion. If the aim of your investment is to gain enough income that you can leave your 9 to 5 then building a property portfolio is a must. You’ll use everything you’ve learned and your power team to invest in and renovate additional properties.

Stage 3: Small Business. You’ll naturally develop a small property sourcing as you expand and grow. You’ll find deals that don’t fit your strategy and can sell them on to other investors. It’s time to look to the future and gain the required compliance to sell property deals.

Stage 4: Established Brand. You’ve built up a property investment brand that is well established. You’ve got the social media strategy and pipeline technology to attract your target audience and have multiple deals to consider.

Not every investor will want to go from stage 1 to 5, many just want a little extra income and are happy in their day job. For those looking to build a financial powerhouse, getting to stages 3 and 4 are the ultimate long-term goals.

Why develop a property investment business?

People are put off from this strategy due to the amount of time, effort and money it takes. At the start of the journey, even stage 2 can seem like an unobtainable fantasy. So, what motivates people to follow this path?

One reason could be that they believe that the long-term returns on property investment are higher than those available from other forms of investment, such as stocks or savings accounts.

Another reason is the challenge and thrill of building something yourself. Instead of being reliant on others paying you a salary, you create your own money making business, you’re the boss.

Many view this as a long term retirement plan, to ensure they can live comfortably for the rest of their lives.

Ultimately, though, any decision to enter into the property development industry should be based on careful analysis and consideration of all the risks involved.

What are the key components of a successful property investment business?

I’ve covered getting started in property investment in this beginners guide, so let’s focus on the later stages. The key components to establish and grow a property investment business are:

People: You need to have a team of experienced professionals who can help you advertise your services to find the right properties, manage your finances, maintain your properties and keep your tenants happy.

Processes: The key to growing a business is having tried and tested processes in place. You need to have well-defined processes in place for everything from promoting your business to finding properties to managing your pipeline of deals. Without well-defined processes, it will be difficult to scale your business and achieve long-term success.

Products: Having a successful marketing machine and deals pipeline is only useful if you’ve a product or proposition to offer. Are you looking to offer property investment deals to other people or do you want others to come to you for investment?

Before starting out, I think it’s important to have a clear idea of what your goals and objectives are. What are you looking to achieve in the short-term, medium-term and long-term? Once you have set your sights on where you want your business to go, it’s important to put together a solid plan outlining how you’re going to get there. This should include factors such as what type of properties you will invest in, how many properties you hope to own within a certain timeframe, estimated acquisition costs and projected rental income.

From there, it’s all about execution – which means staying disciplined with both your finances and your time management. In terms of finance, this means having enough cash reserves available so that when an opportunity arises (such as a bargain purchase – perhaps a BMV deal), you can take advantage of it without putting too much strain on your existing portfolio or taking out high interest loans.

And finally – don’t forget the importance of building up strong relationships with industry professionals who can help support the growth of your property investment business!

What is a property pipeline?

You will naturally develop some components mentioned above as you expand your portfolio, but pipeline management is likely a new area you won’t have dealt with in the property space.

A pipeline is a representation of the steps required to conduct business and a typical pipeline includes four stages: lead generation, qualification, negotiation, and close.

Each stage represents a different step along the path to closing a deal:

Lead generation is the process of finding prospective buyers for your product or service.

Qualification involves evaluating leads to see if they meet your criteria for buying.

Negotiation is the part of the process where you try to convince the buyer to take action.

Close is the final step in the process, where you agree on a price and the terms of business.

The key to making this work is to have the processes in place. Depending on your day job, this might sound very familiar as it’s not property specific, it’s how businesses operate in the digital era.

To learn more about this I sat down with Andy Phillips, founder of propertypipeline.pro, who has over 25 years’ experience in the digital marketing space. He gave me some really useful tips about the processes he has put in place for growing property sourcing companies.

Landing page

Think of a landing page as a simple website. Instead of including lots of information and pages, it’s usually one page with one call to action. The lack of navigation buttons removes distractions and means the site is 100% focused on getting sellers to register contact details with you.

Andy says the best landing pages include the following:

- A call to action in the header

- A list of your accreditations

- Pictures of your team

- A second call to action

- Information about who you are and what you offer

- Additional call to actions, so they are visible as visitors scroll down the page

A call to action is a button with text on that calls the visitor to action, for example “Get a quote”. This prompts the visitor to enter their details on a form which drops them into your pipeline.

Emails

The point of property investment is to give you more time to do the things you want to do. Sending emails is unlikely to be on that list!

However, when someone gives you their details, you’ll want to follow up with an email. Fortunately, you don’t need to do this manually; this process can be automated so that when they fill out your form they automatically receive a confirmation email.

Depending on your offer, you may have a lead magnet, which is something you send to visitors in return for their email address, for example an investor pack.

Automation can also assist later in the process as well. For example, if they decline your offer initially, they can automatically be sent emails at a later date to see if they’d be interested in a further discussion.

CRM Software

Customer Relationship Management (CRM) software not only stores all the contacts collected via the landing page, it should also show you where they are in the pipeline.

This is hugely important when operating at scale over a long period of time. It’s easy to remember where you’re up to with a single person, but can you keep track of what you emailed to other people 1 week ago? 1 month? 6 months?

This is the heart of your pipeline.

Appointment Scheduler

The online world is great for automating a lot of business processes, but there comes a time when you’ll need to have real life conversations. An appointment scheduler helps avoid the back and forth ‘are you free on…’ conversation by giving a way for people to quickly and easily book a meeting with you at a time that works for you both.

Cost of a property pipeline

I’m not a technical person, I like to focus on blogging and business rather than what software platform to use. Fortunately, I’ve a tech person on my power team, so I asked Mark, from iindigo, what we would need to build a system like this.

“This is a complicated setup that would require a number of different systems to achieve what you’ve outlined. I’d think it can be done using the following:

- Clickfunnels ($97/month)

- Constant Contact (starts at $39/month)

- Zoho CRM (starts at $13/user/month)

- Calendly (has a free plan)

There would be a lot of setting up to do to get all the systems talking to each other, so as well as around $149 a month you’d be looking at setup costs running into the thousands to get someone to sort this for you.“

Mark mentioned that some of the above services charges had been converted from UK£ to US$ to give a monthly total.

You don’t become a successful property entrepreneur unnecessarily spending money, and this seems very expensive.

It turns out this cost and complexity is the very reason Andy Phillips created propertypipeline.pro. The system has been created to get you up and running very quickly, and includes:

- Website

- Pre-written email sequences

- CRM and pipeline management software

- All automation built in

- Appointment scheduling

What are the common mistakes made when starting a property business?

The most common mistake made when starting a property business is rushing in without having done enough research.

Not having a clear plan: This can lead to confusion and frustration when things don’t go as expected. Not having a clear plan can also make it difficult to raise capital and find the right team. It’s better to work with someone who can guide you through the process than make mistakes that could cost you your return on investment.

Not understanding the market: Another common mistake is not understanding the market. Running a property business is different to investing in one or two properties over many years. Inexperience can lead to making poor investment decisions and missing out on opportunities.

Not having the right team: A final common mistake made when starting a property business is not having the right team in place. The right team will have experience in the industry, be able to provide advice and support and be able to help grow the business.

While I have my own team, over the years I’ve learned the value of networking with others in the industry, such as Andy who provided the valuable information above. If you’re unsure how to meet others in the industry, check out: How do property investors connect? It’s easier than you think

What are the exit strategies for a property business?

Let’s take an ultra long look into the future and consider what happens when you’re ready to leave the property market.

In general, most people will sell the property business to another party, either through a broker or by negotiating directly with a potential buyer. If you have built up a strong brand and have a good reputation, this can be a very profitable way to exit your business.

If you don’t want others to use your brand, but you still want to dispose of your investments, then selling the property portfolio is an option, perhaps to another investor. This is often done when the market is hot and properties are selling for high prices. It can be a quick way to make a profit, but it does mean that you will no longer have any involvement in the property market.

The final option is one no one wants, but it’s important to make you aware this could happen: Liquidating the business. If your property business is not doing well, you may need to consider liquidating it. This means selling off all of your assets and using the proceeds to pay off your debts. It can be a difficult decision to make, but sometimes it is the best option for businesses that are struggling financially.

What are the challenges faced when running a property business?

Establishing a full-time business brings new challenges you need to deal with.

Changes in the market: The property market is constantly changing, so it’s important to keep on top of trends and developments. This includes understanding the latest legislation and knowing what’s happening in the local area.

Access to finance: One of the biggest challenges facing any business is access to finance. This can be difficult to obtain, especially for start-ups. It’s important to have a solid business plan and approach potential lenders with confidence.

And of course, if you were hoping to have a more relaxed lifestyle you might find there are times when you’re working harder and longer than ever before. However, when it’s your business it’s different, you’re building something for yourself.

How can you make your property business more successful?

No matter what business you’re in, marketing is essential to success. In the property business, it’s especially important to be proactive and get your name out there. There are a number of ways to market your business, including online marketing, print advertising, and word-of-mouth.

Developing a niche: One way to make your property business more successful is to develop a niche. This could involve specialising in a certain type of property or working with a particular clientele. By focusing on a specific area, you can become an expert in that field and stand out from the competition.

Building a strong team: Another key to success in the property business is having a strong team behind you. This includes everything from experienced agents to reliable support staff. Having a team you can rely on will make it easier to get the job done and provide excellent service to your clients.

Offering great customer service: Excellent customer service is essential for any business, but it’s especially important in the property industry. Your clients are entrusting you with one of their most valuable assets, so it’s crucial that you provide them with the best possible service. This means being responsive to their needs, keeping them updated on progress, and going the extra mile to ensure their satisfaction.

What are the different types of property niches?

I mentioned above that you should consider targeting a specific niche. Becoming established in a specific area can open up other opportunities, for example, you might work with others who have complimentary services.

Commercial Property

A commercial property is one where people work in order to make money. Examples include offices, shops, restaurants, hotels, banks, etc.

Consider working with businesses who provide services such as leasing, property management, and security.

Industrial Property

An industrial property is any building or structure used in manufacturing, processing, storage, distribution, or other commercial activities. The term “industrial” refers to the type of business conducted at the location.

You might work with other businesses that provide services such as warehousing and distribution.

Retail Property

A retail property is any building where goods are sold from a shop front. Examples include department stores, grocery stores, restaurants, bars, etc.

You could partner with others who provide services such as shop design and layout consulting.

Hospitality Property

A hospitality property is one where people come in from outside to stay overnight. Examples include hotels, bed & breakfasts, hostels, etc.

This sector would benefit from businesses who provide services such as event planning and catering.

What are the benefits of having a successful property business?

A successful property business can bring in a lot of money. This can allow you to live a better lifestyle and provide for your family.

More free time: A successful property business can give you more free time…some of the time! There is a lot of hard work involved, but you will be your own boss and will have the option to spend more time with your family and friends or pursue other interests.

Greater control over your life: Owning a successful business gives you greater control over your life. You will be able to make decisions about how you want to live and work.

The ability to help others: An often unconsidered aspect when starting out, a successful property business can give you the means and opportunity to help others by providing them with jobs and other opportunities.

Final Thoughts

Having a single rental property and seeing the return on investment from that alone is often enough to satisfy the financial goals of those looking to do more with their money than leave it sat in a savings account.

However, those who get the bug, who become experienced property investors, will want to continue their journey further and build a long term real estate business.

The property industry continues to be a highly profitable one. I hope this article has inspired you on your property journey.

- Property Investment Guide for Leeds - November 30, 2024

- Best Areas to Invest in Manchester - November 30, 2024

- Property Investment Guide for Manchester - November 30, 2024