Amidst the ebb and flow of market uncertainties, the steadfast performance of house prices in the UK has been a notable phenomenon, showcasing an unexpected resilience that has captured the attention of analysts and investors alike. As we explore the underlying factors that have bolstered this stability, a deeper understanding emerges of the intricate dynamics at play in the real estate sector. The interaction between regional nuances, mortgage rates, and expert insights reveals a multifaceted landscape where trends intersect and diverge, offering a compelling narrative of resilience against a backdrop of fluctuating market conditions.

UK House Prices Performance Overview

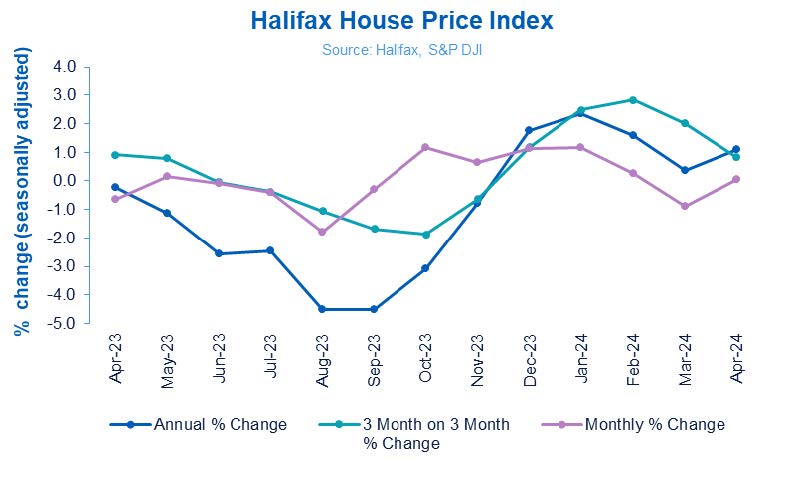

In the domain of UK house prices, a notable upward trend has been observed, with the average price experiencing a modest increase of 1.1% in the year leading up to April 2024. This growth signifies a positive shift in the market, indicating signs of stabilization after earlier fluctuations.

A prominent feature worth noting is the North/South house price divide, with the North showing resilience through price increases while the South faces declines. For homeowners looking to add value to their properties, understanding regional disparities and market trends can guide strategic decision-making.

Keeping an eye on these regional dynamics can help navigate the market effectively and make informed choices when it comes to property investments or sales.

UK house prices held steady in April, rising on a monthly basis by just +0.1% (less than £200 in cash terms). Annual growth rose to +1.1%, from +0.4% in March, though this can be attributed to the base effect of weaker price growth around this time last year.

UK house prices held steady in April, rising on a monthly basis by just +0.1% (less than £200 in cash terms). Annual growth rose to +1.1%, from +0.4% in March, though this can be attributed to the base effect of weaker price growth around this time last year.

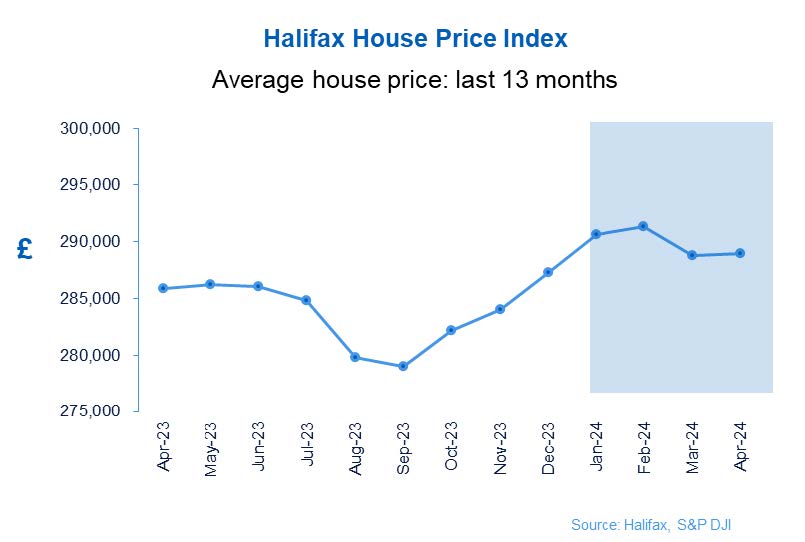

The average property now costs £288,949, compared to £287,244 at the start of the year. While there is always much scrutiny of monthly price changes – and a degree of volatility is to be expected given current market conditions – the reality is that average house prices have largely plateaued in the early part of 2024.

This reflects a housing market finding its feet in an era of higher interest rates. While borrowing costs remain more expensive than a few years ago, homebuyers are gaining confidence from a period of relative stability. Activity and demand is improving, evidenced by greater numbers of mortgage applications so far this year, while at an industry level mortgage approvals have reached their highest point in 18 months.

Our recent research also found that buyers are adjusting their expectations, with first-time buyers in particular compensating for higher borrowing costs by targeting smaller properties. We see this reflected in property prices for the first few months of this year, with the value of flats rising most sharply, closing the ‘growth gap’ on bigger properties that’s existed for most of the last four years.

However, we can’t overlook the fact that affordability constraints are still a significant challenge, for both new buyers and those rolling off fixed-term deals.

Mortgage rates have edged up again in recent weeks, primarily as a result of expectations around future Bank of England base rate changes, with markets now pricing in a slower pace of cuts.

If, as is still expected, downward moves in Bank Rate come into play later this year, fixed mortgage rates should fall. Combined with the resilience displayed by the housing market over recent months, we now expect property prices to rise modestly over the course of 2024.

Amanda Bryden

Head of Mortgages, Halifax

Impact of Regional Disparities

Amid the prevailing trends in the UK housing market, the impact of regional disparities is manifesting through distinct price movements and market dynamics, particularly evident in the contrasting performance between the North and South regions.

The North/South house price divide is becoming more pronounced, with the North experiencing price increases while the South sees declines. This regional price disparity is influencing market activity, with higher prices in the South affecting buyer behavior and market momentum.

Regions like the North West and East of England are showing positive price movements, highlighting the variances in regional housing markets. Understanding these regional differences can provide valuable insights for homeowners looking to maximize the value of their properties amidst the North South divide and regional price disparities.

Mortgage Rates and Market Trends

The current landscape of mortgage rates and market trends reveals a complex interplay of financial dynamics shaping the housing sector. Mortgage affordability is a key concern for many potential homebuyers, especially amidst market volatility.

With the average 2-year fixed rate mortgage rising to 5.87% in April, homeowners are facing challenges in balancing their budgets. Banks adjusting rates due to the Bank of England‘s delayed cuts add further uncertainty to the mix.

To navigate these fluctuations and make informed decisions, individuals may consider exploring different mortgage options, comparing rates from various lenders, and seeking expert advice on managing their finances efficiently. By staying informed and proactive, homeowners can better position themselves to handle the current market trends and potentially find opportunities to enhance their home value.

Expert Analysis on Market Dynamics

The intricate dynamics of the housing market are under close scrutiny by financial experts, providing essential insights into the current state of market trends. Experts explore market dynamics to decipher the complexities shaping pricing trends:

- Regional Variations: Disparities in house price performance across regions are influencing overall market dynamics.

- Economic Factors: Fluctuations in mortgage rates continue to impact pricing trends, affecting market momentum.

- Consumer Behaviour: Shifts in consumer preferences and buying patterns are contributing to evolving market dynamics and pricing trends.

What do others in the industry think?

House prices are yo-yoing as buyers and sellers negotiate their way through the uncertain economy, with a small monthly rise in April.

Consumers are expecting a fall in interest rates at some point this year. But with lenders increasing rates in the last few weeks, buyers have understandable hesitancy over the right price to offer, while sellers are trying to navigate how offers align with their expectations.

Yet despite this confusion over pricing, demand is holding up well, with mortgage approvals continuing to rise and supply levels improving.

All attention turns to the Bank of England, as a fall in the base rate this week would help to solidify confidence in the housing market.

Nicky Stevenson

Managing Director, Fine & Country

Also:

The property market is becoming ever more adept at rolling with the punches – and the Halifax’s April data suggests prices have begun to find a new equilibrium.

The big change this spring has been the surge in supply. In some areas the number of homes being put up for sale has gone from trickle to flood.

Many estate agents report that the number of homes coming onto the market is four times higher than the number of prospective buyers registering their interest.

This abundance of supply is doing two things – swinging the balance of negotiating power decisively back in favour of buyers and applying downward pressure to prices.

But the price falls have been modest compared to the sharp correction seen during the chaotic aftermath of Britain’s short-lived Truss era. After falling in March, the Halifax’s data shows average prices stabilised in April.

There’s a growing realisation among home-movers that higher borrowing costs are now a medium-term, than short-term, feature of the moving landscape.

As a result buyer numbers are picking up, but with the average cost of borrowing rising past the levels seen at the turn of the year, first-time buyers in particular are seeing their affordability stretched and as a result remain acutely price-sensitive.

That’s why we’re seeing prices rise fastest in regions where affordability is better. Over the past year, average prices jumped by 1.5% in Scotland and 3.3% in North West England, but dropped by 1.1% in Eastern England.

With such a wide gap – 4.5% – between the best and worst performing areas, buyers need local data on which to base their plans as national headline data can be misleading.

Regional differences are throwing up some strong buying opportunities, but across the UK as a whole we’re likely to see price growth meander for the next few months as we wait for mortgage rates to start falling again.

Jonathan Hopper

CEO of Garrington Property Finders

Current Market Outlook

Market dynamics in the housing sector are currently reflecting a cautious optimism as indicators point towards a potential stabilization in prices following earlier fluctuations in 2024. This trend highlights market stability and price resilience, offering homeowners a sense of reassurance amidst recent uncertainties.

As the housing market shows signs of plateauing, now might be a strategic time to contemplate value-boosting home improvements. Simple upgrades like enhancing curb appeal, updating kitchen fixtures, or investing in energy-efficient upgrades can not only enhance your living space but also potentially increase your home’s value.

Final Thoughts

To sum up, the UK housing market has shown remarkable resilience amidst ongoing fluctuations, with a positive shift in dynamics indicating potential stabilization. Regional disparities continue to impact market trends, influencing buyer behavior.

To add value to your home, consider making strategic upgrades such as improving curb appeal, updating kitchens and bathrooms, and enhancing energy efficiency. By staying informed on market trends and making smart investments, homeowners can navigate the market with confidence and maximize their property’s value.