Losing a loved one is difficult enough, but the additional responsibilities are significant when you have been appointed executor or personal representative of the estate. Lengthy probate or financial concerns for the estate can lead the executor to explore the possibility of renting out the property to provide a regular income to offset debts.

You can rent a property before probate. There are some considerations, such as the property’s contents and how the proceeds will be handled. The executor has the legal authority to rent a property and collect rent on behalf of and solely for the estate’s benefit.

I’ll discuss some details to consider when renting a property before probate. I’ll also share some best practices to follow before entering into a rental agreement before probate, including how to appropriately document rental income and ensure it is deposited directly to the benefit of the estate.

If you’re new to property investment I’ve a treat for you: I’ve arranged for a free digital copy of Property Magic by Simon Zutshi. It covers various topics, including creative property buying strategies, maximizing cash flow, forming a power team, and a new strategy for current market conditions.

Those of you smart enough to grab a copy of this excellent book will also be treated to a free 3-part training video plus 20-minute property education call with Simon’s team. If you’re just getting started in the rental business you’ll find the book, training and call highly valuable.

Considerations Early in the Process

Losing a family member or friend is never easy, but planning how to proceed when it happens is essential. The probate process is notoriously laborious. Probate can take between three and twelve months, depending on the complexity of the estate, with the majority falling in the six to twelve-month range.

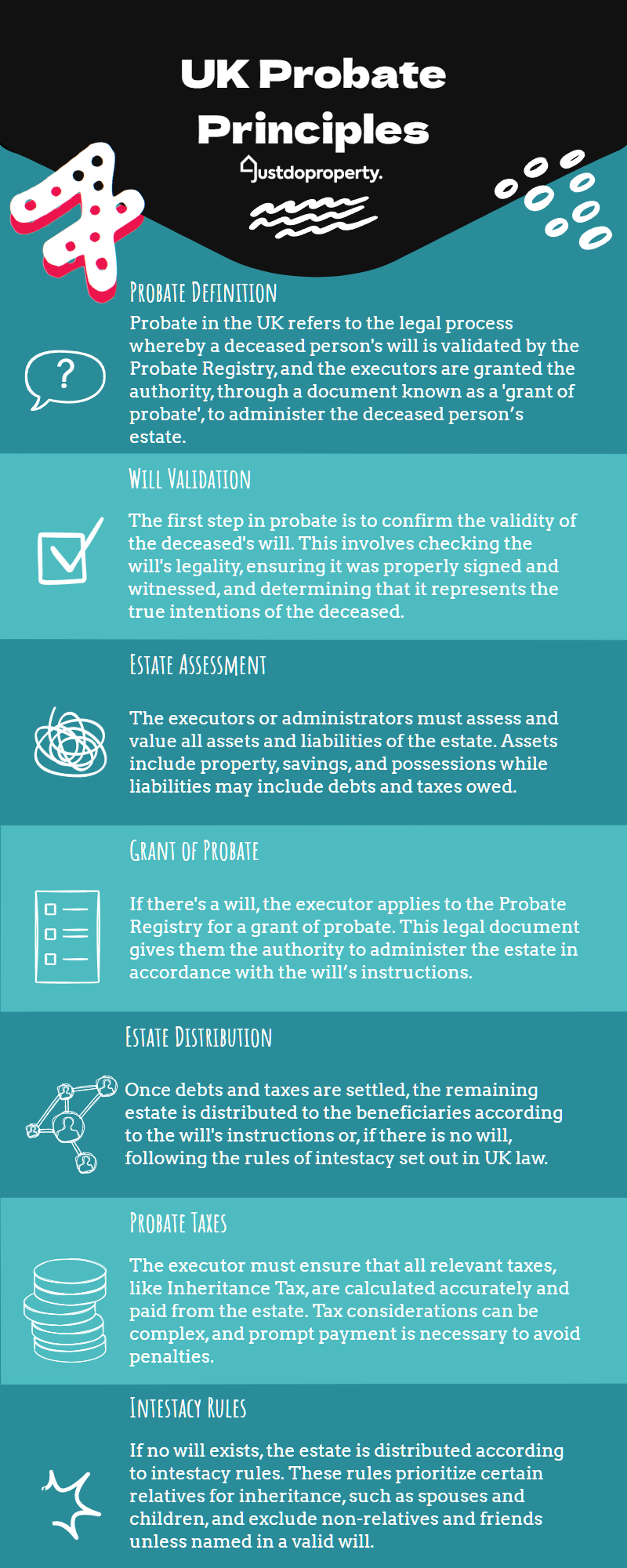

With this in mind, it’s essential to meet with the solicitor of the estate and begin the process of the probate of the will as soon as possible. Many know the term, but don’t understand what it is or how it affects a will, an estate, or beneficiaries.

Loosely defined, probate is the process by which the legal entity of the government determines the legal right to deal with assets after a person has died. This is also called “Grant of Confirmation” in Scotland according to My Probate Partner. If a will exists, the probate process can be less burdensome. If there is no will, probate can get complex and prolonged.

Impact of Probate on Ability To Sell Assets

Probate is not only the process of determining assets and their legal rights after a person’s death but also ascertaining debts and how those will be settled. Therefore, it’s not legal or appropriate to sell assets before probate except in certain circumstances.

Working with a solicitor is essential if you are the executor of a will that is complex or consists of many assets and/or debts. A solicitor can advise when you can and should legally sell assets on behalf of the estate to settle debts.

You should never sell assets on behalf of an estate prior to probate without first speaking with your solicitor or clearing it with the court. Doing so could open you up to personal liability, even if your actions are on behalf of and in the estate’s best interest.

Renting Versus Selling

As you know, the property can’t be sold before probate, but what if the estate requires ongoing income to pay debts or keep things afloat until it clears probate? An approach many consider is renting the property before probate.

Before you put the house on the rental market, there are some serious considerations for the executor or the personal representative. First, now that the property is uninhabited, you are responsible for ensuring it is safe and protected. The worst thing you can do is advertise assets in a vacant property.

Next, consulting with a solicitor is vital to ensure that you, as the executor, can legally sign a lease on the property before probate. A solicitor can best advise on what type of lease is appropriate for the property and what terms are going to be most advantageous and protect the interests of the estate.

If you’d rather sell the property, we have a recomendation on who to use.

Assets That Come With the Property

A solicitor must be consulted about any belongings that remain in the property. As previously mentioned, probate is the process by which the court determines assets and debts for an estate. It stands to reason that the court will not want any assets moved or removed without prior input or approval.

Be prepared to provide an alternative to disposing of or selling the assets before probate. For example, your solicitor may be able to negotiate renting a property with the understanding that all estate assets from the property will be secured in a temporary storage facility.

Another possible alternative is to inventory the assets as they are being packaged for storage. This could be a helpful task to move the process forward while also accomplishing the end goal of renting the property. Think through a few alternatives and be flexible when discussing your options.

Rental Income From the Property

Before probate, the estate cannot be considered settled. Consequently, who benefits from the estate is also not resolved. Therefore, no entity or individual may personally benefit from income from selling or renting items within that estate.

If your solicitor has advised that renting the property before probate is legal and appropriate, also discuss how the rental income will be handled. This is just as important as consulting with a solicitor if you have the legal authority to sign a lease of the property on behalf of the estate.

When entering a rental agreement before probate, it’s critical to set up the financial beneficiary of rental income as the estate account. It may seem more straightforward to collect the rental income and pay it back to the estate, but doing so may open yourself up to liability for other debts.

Additionally, as the executor or personal representative, you are legally appointed to do what’s in the estate’s best interest. It’s critical that you not do anything that isn’t in the estate’s best interest but also avoid doing anything that appears to not be in the estate’s best interest.

Again, your best course of action is to consult with a solicitor. Since renting the property has financial implications for the estate, it’s also worth discussing the estate and rental agreement with a financial advisor to check if they envisage any potential pitfalls, either current or future, with the arrangement.

Renting With a Contentious Will or Estate

If you’re an executor of an estate and the estate settlement is adversarial, it may be best to forego renting out the property before probate. There may be contentious estate situations where financially, it is in the best interest of the estate to rent the property regardless of drama.

In these situations, renting out the property through a property management agency is best. The property manager can deal with the renters, handle all paperwork, respond to issues with the property, and direct the financial benefits to the estate.

A property management company will erode some of the profits from renting the property but ultimately handles the day-to-day management and financial arrangements. More importantly, using a property manager provides one more objective party dealing with the property during adversarial probate.

Final Thoughts

Dealing with the death of a loved one is never easy. As the named executor, the best thing you can do is to find a reputable solicitor and discuss your options with them.

With the help of your solicitor, begin the probate process as soon as possible to prevent a high solicitor’s bill.

Avoid doing anything that conveys that you are taking personal responsibility for any debts or liabilities, or removing assets from the estate for personal gain.

Document all decisions, processes, and transactions through the solicitor as you never know when you might need it.

Sources

- Gov UK: Applying for Probate

- Gov UK: Dealing With the Estate of Someone Who’s Died

- NiDirect: What To Do If There Is No Will

- Is It Bad To Buy a Flat Instead of Renting? - February 20, 2023

- If You Buy a UK House at Auction, When Do You Pay? - February 15, 2023

- Why Are Houses in the UK So Overpriced? - February 7, 2023