Unfortunately, we currently live in economic times that will see money in savings losing value over time due to high inflation. Many people are wondering if there is a better option to make cash work harder and have wondered if it’s possible to buy a house to rent out.

Yes, you can buy a house and rent it out. This is called buy-to-let and is a popular type of investment with many benefits, such as making money on the side, increasing your net worth, and creating a new income stream.

There are many things to think about when considering buying a house and renting it out. Over time, I’ve built up a healthy property portfolio that has become my main source of income. In this post I want to help you understand the pros and cons of investment properties.

If you’re new to property investment I’ve a treat for you: I’ve arranged for a free digital copy of Property Magic by Simon Zutshi. It covers various topics, including creative property buying strategies, maximizing cash flow, forming a power team, and a new strategy for current market conditions.

Those of you smart enough to grab a copy of this excellent book will also be treated to a free 3-part training video plus 20-minute property education call with Simon’s team. If you’re just getting started in the rental business you’ll find the book, training and call highly valuable.

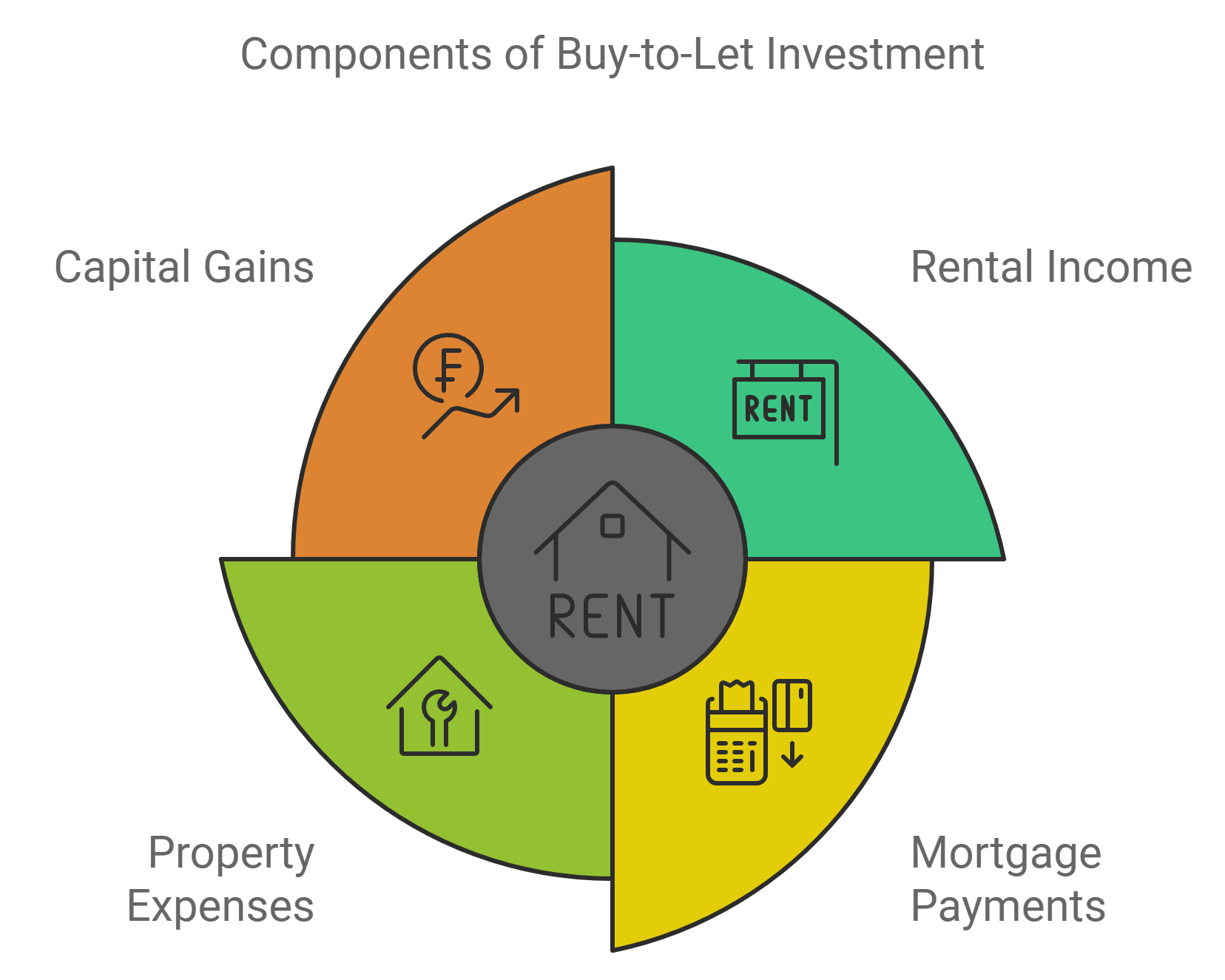

How does a buy to let work?

A buy-to-let is a property that you purchase and then let out to tenants who pay rent each month.

You are the landlord and are responsible for maintaining the property, finding tenants and setting the rental price. You make money by charging a rent which will cover your expenses, such as mortgage payments.

If you own multiple properties that are rented out, you have a property portfolio.

Pros of Renting Out a House

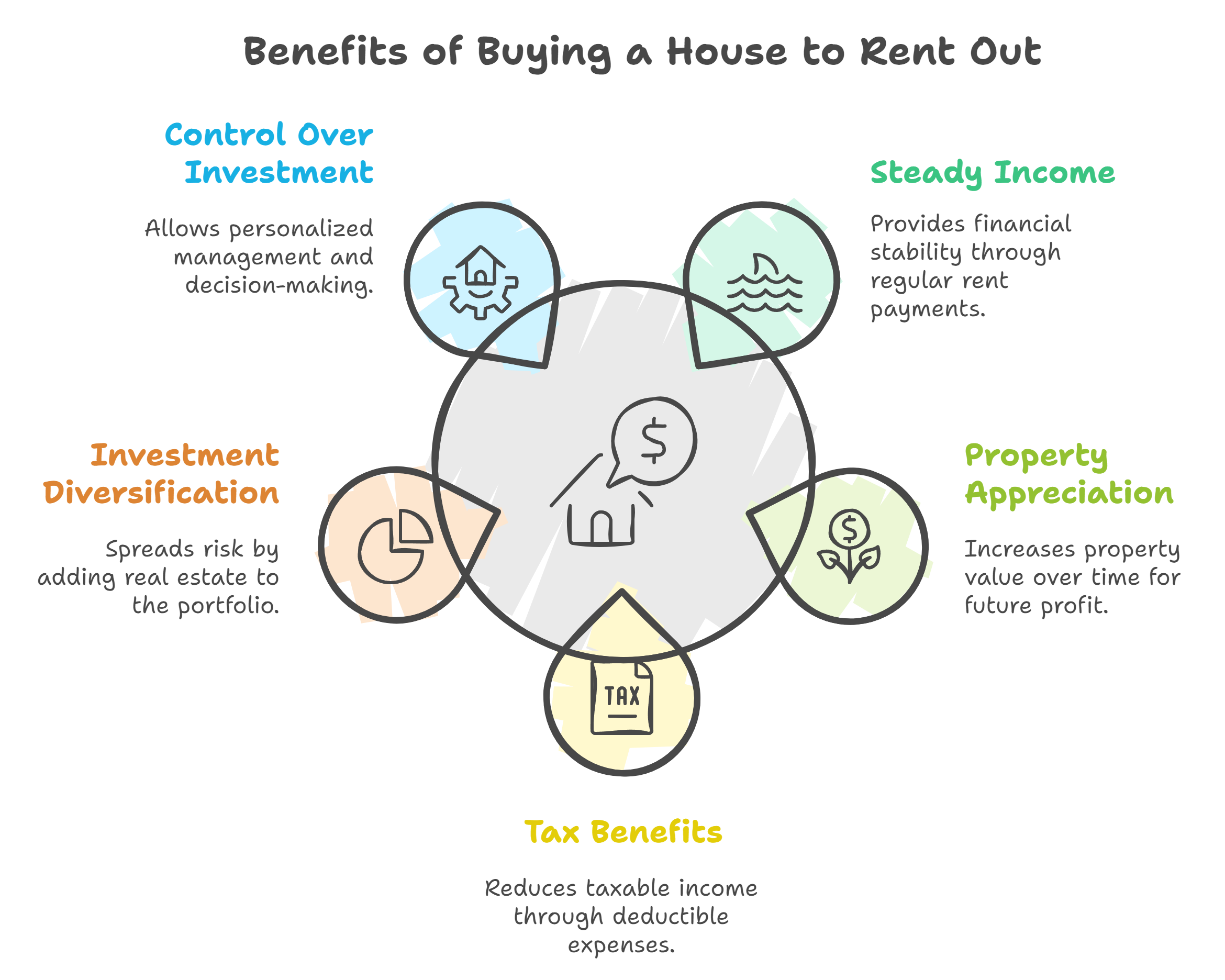

I found there are lots of pros to investing in properties. For starters, in the long run, it can be financially beneficial. It’s not a get rich quick scheme, but I’ve certainly seen a return on investment for the properties I own.

My goal was to create a full time income from investment properties, building up a property portfolio that provided me with regular rental income, and over the last 10 years I’ve done just that.

It can be something you do in addition to your main job or, in time, it can be your full time job. In either case being a property owner should be approached like a business, tracking your income and costs, and submitting a tax return.

Doing so means your costs can be classed as a business expense, and therefore many of the expenses associated with owning a buy-to-let home are tax-deductible.

Renting out a property can help you build up retirement savings or help you meet other financial goals faster than if you just have savings. The rent collected offsets any mortgage taken out, repair costs and expenses to run the home while earning appreciation on it–all at once!

And, of course, property prices trend upwards, which means when the property is eventually sold you should make additional money from the increase in property value.

Cons of Renting Out a House

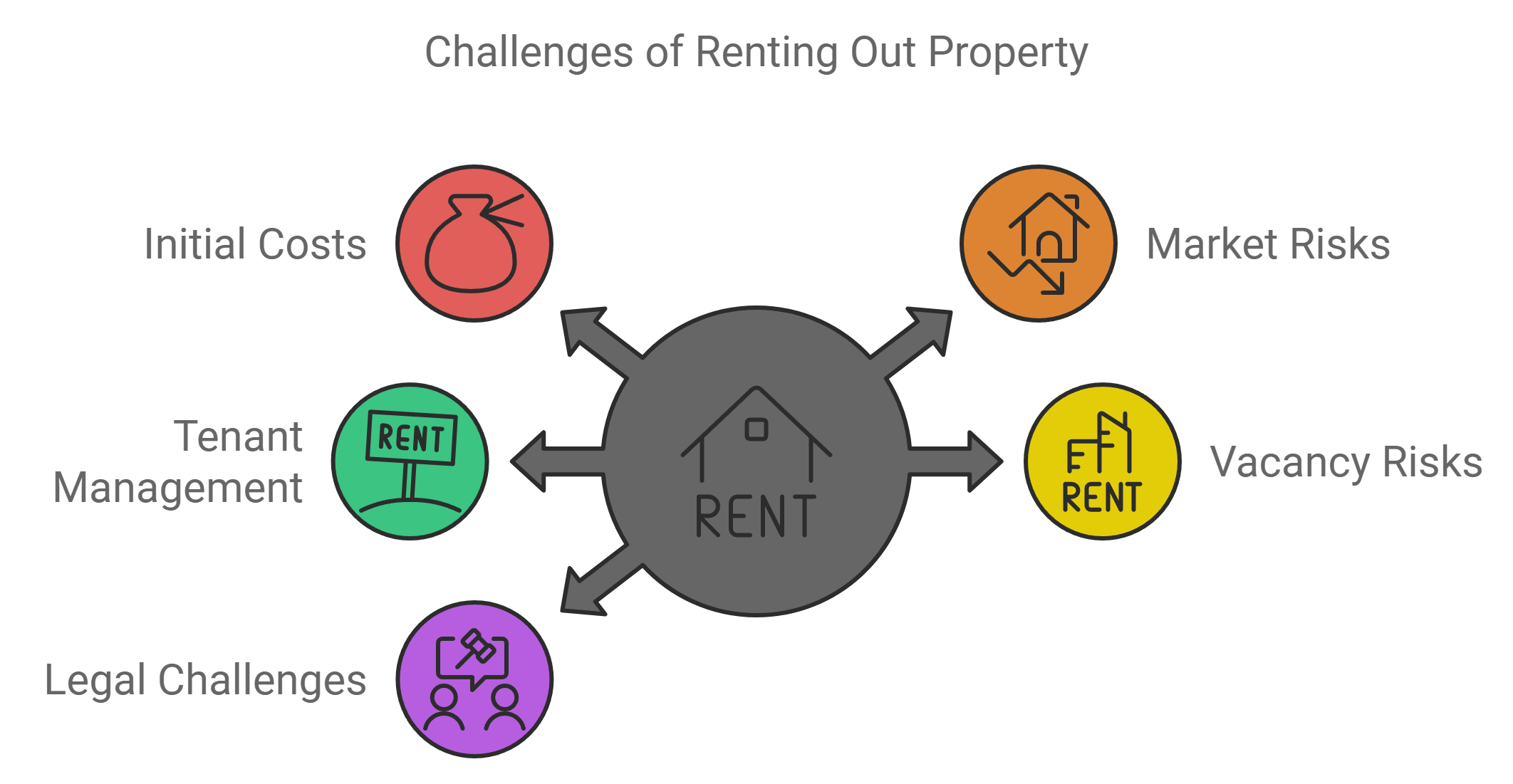

This might all sound too good to be true, regular income that pays for a property which is also increasing in value. What could go wrong?

Well let me tell you, over the last 10 years I’ve encountered all sorts of issues that would certainly put off a lot of people from entering the market.

When you’re renting out a house, there are a lot of things to take into account–from financial implications to taxes. In fact, there is so much to do you should consider it a second job.

To earn that extra income, you need to conduct research into the area, set competitive prices that cover your costs but also make you a profit, find tenants, agree legal contracts, arrange for property maintenance, deal with bad tenants, get new tenants in when old ones move out, the list goes on!

Another thing to consider is that it takes money to enter the property market. You need enough cash for a deposit, as well as money saved for repairs, renovation, legal fees and other unexpected costs that may come up along the way.

Rental markets can be difficult to navigate and if you don’t have the knowledge and experience you have two options, pay for expert help or try and go it alone (which can take time and potentially more money if mistakes are made). It may not always be financially viable for everyone to enter this market.

Another thing to think about is the fact that renting out your home can feel like a second job. There are many legal responsibilities and issues and it can take a lot of time to deal with the various issues that crop up.

When everything is going well it’s as close to passive income that you could hope for, but there are a lot of elements that come with being a landlord, so make sure you’re fully prepared for them before taking on this role.

Things to Consider Before Renting Out a House

Before you start looking for properties to rent out, here are some things to keep in mind:

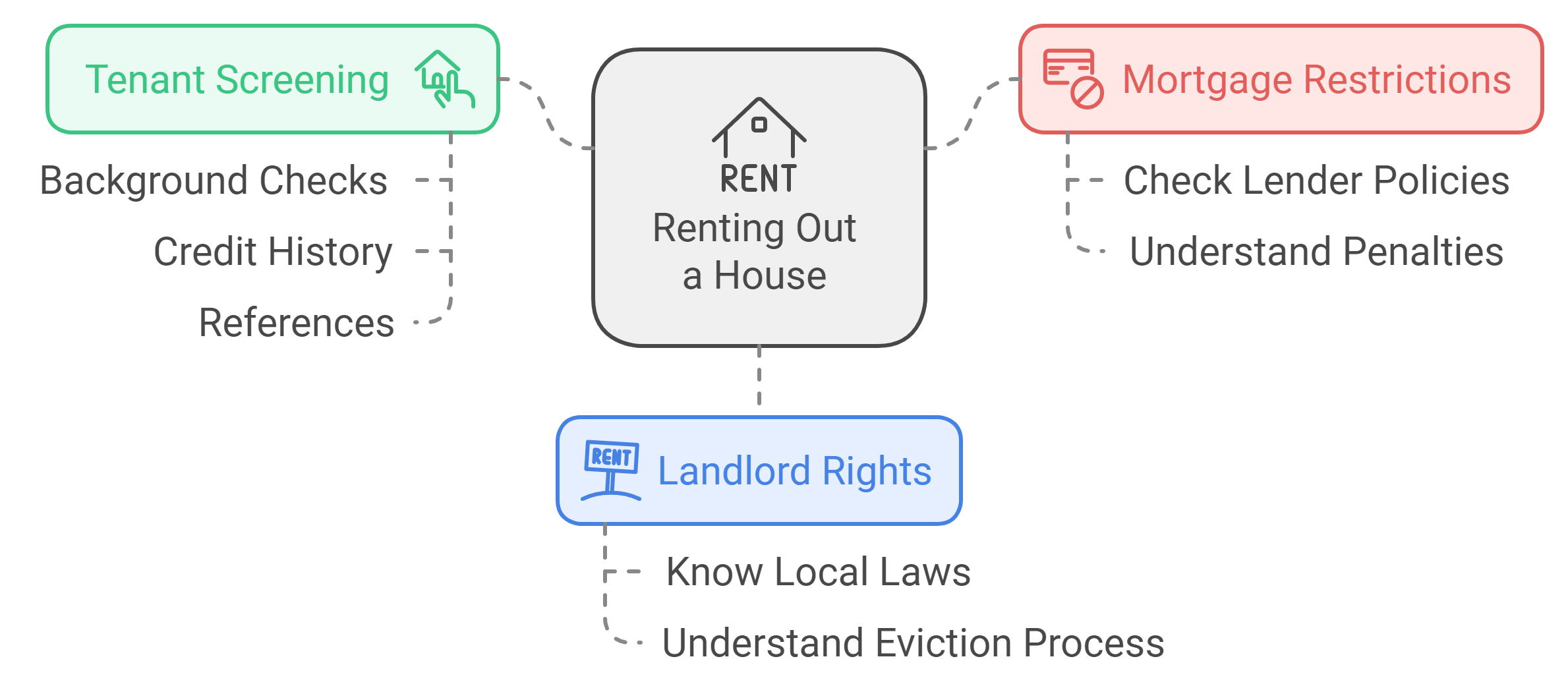

Check if your mortgage lender has any restrictions

If you’re thinking of renting out your own property, be sure to check with your mortgage lender first. Lenders can have different restrictions on what type of properties they will finance. For example, many lenders require the owner to live in the home for at least one year, unless there is an extenuating circumstance.

Some lenders might charge a fee or require you to refinance your property if it is rented out. It’s important to contact your lender and ask about their specific rules and requirements before signing any lease agreements.

Know your rights as a landlord

As a landlord, you have the right to evict tenants for not paying rent, violating the lease agreement or damaging property.

Landlords can also charge late fees for rent that’s paid after the due date and can screen potential tenants before renting to them.

It’s important to remember that as a landlord, you are responsible for repairs to the property (except in cases of tenant damage) and must provide a safe and habitable living environment for your tenants.

Screen your tenants carefully

When renting out your house, you have to be very careful about who you choose as tenants. This is because you are responsible for the property and all related costs, such as mortgage, repairs, and bills.

You also need to advertise the property and find the right tenants, so it’s in your financial interest to find good tenants that will rent from your for as long as possible.

Make sure that you screen them carefully before signing any lease agreement. A property manager or local estate agent can take care of many of these tasks for you, but it will likely add to your overall costs. I always get an agent to find a tenant for us as I want to make sure that all the legal processes are followed.

How to Be a Successful Landlord

Now that we’ve covered the pros and cons of becoming a landlord, let’s talk about how to be successful.

Here are some tips to get started:

Do your homework before you buy

Research the area, the type of property that is in demand, your expected mortgage payments, related property taxes, expected maintenance costs, and so on.

This can take a lot of time to do, but it can help you avoid so many mistakes when you finally enter the property market.

Don’t be afraid to speak to experts, they know their particular industries inside out and paying for a little of their time can speed up your understanding of the market.

Check out our expert panel if you’re unsure who to speak to: Expert Panel

Set the right rent

When it comes to setting the rent, you’ll want to consider a few things. The first is the location of your property. A neighborhood can have a specific type of renter that may or may not be the ideal person for you to rent to. You also need to think about what amenities are nearby, and how close the property is to private and public transport options as well as employment or educational opportunities.

Another thing you’ll want to keep in mind is vacancy rates. Make sure that your rent isn’t so high that people won’t want to live there, but also remember that you need to make a profit on the investment as well.

Finally, don’t get emotionally invested in a property that won’t make enough money, if it’s not making ends meet, chances are it’s not going to last long in today’s market. Above all else, don’t invest too much time or energy into such a property because it won’t generate sufficient returns.

Consider using a property management company

Many people are under the impression that they cannot be landlords if they do not live in the same city as their rental property. This is untrue, and there are a number of ways to find tenants and manage your property without living nearby.

One way to make sure your investment is successful is to use a property management company. Property managers can help you rent your house for more than you expected and often have a wide pool of applicants to choose from.

They also take care of all the paperwork, such as checking references, credit scores, and drafting lease agreements. Additionally, they will keep an eye on your property and make sure repairs are made when needed.

The right property manager can help increase your revenue while decreasing the amount of work you need to do yourself.

It is important to interview multiple companies before making a decision. Ask them about their experience with similar properties and what kind of screening process they have for potential tenants.

How to Rent Out a House

Here are some quick pointers on how to rent out your new investment property.

Check rental prices near your property

It’s important to know what the going rental rate is in your area before you set your price. You can use websites like Rightmove or Zoopla to check out averages for your area, or talk to a local estate agent, and adjust your price accordingly. Keep in mind that vacancy rates and rent prices can change quickly, so it’s a good idea to revisit these sites often.

Check if your home insurance covers rental properties

Landlord insurance is a good way to protect your investment. Standard homeowners insurance policies may not cover damages incurred by renters.

There are insurance policies which can be combined with a homeowners policy to cover rental-related issues.

Insurance agent should be consulted before renting out the property, if you’re not sure who to talk to I recommend our insurance expert.

Understand the rules and regulations around renting

There are rules and regulations that homeowners must follow when renting out their primary residence. Lenders will impose these rules in order to protect their investment.

Each lender is different so be sure to take the time to understand the contract you’re entering into. You should also make sure to have savings in reserve to deal with any unexpected maintenance or legal costs.

Choose the right location for your rental property

When you’re looking to rent out a house, it’s important to pick the right location. You want to find an area with high rent prices and low vacancy rates. This will ensure that you get the most out of your investment.

Keep in mind that rentals can be risky, but they also offer rewards.

Do your research before buying a rental property, and make sure to consider local amenities and crime statistics for the neighborhood.

If you invest wisely, renting out a house can be a lucrative venture. See our beginner’s guide for more tips on research.

Decide on the type of rental property you want to offer

Before buying a rental property, it helps to figure out your goals and decide whether you want to be a real estate investor or not.

Rentals can often provide passive income streams and support your goals financially, but they may make sense to sell instead of renting.

If the market is a seller’s market, the demand for homes outstrips supply and renters will have the advantage. In this situation, it may make more sense to rent your home out than sell it.

If you’re not in a rent-friendly area, then renting out your home may be a bad idea. Before making any decisions, research the local rental market so that you have an accurate picture of what is happening there.

In some cases, it may make more sense to rent the house out while you’re still living there. If the house is in a desirable location, for example, or if you can’t find a buyer right away, then renting it out may be the best option.

Choose the Right Tenants for Your Property

When you’re renting out a property, finding the right tenant is key. You don’t want someone who’s going to trash your house or not pay rent on time. Here are some tips for choosing the right tenants:

1. Craigslist and Facebook Marketplace are still viable options for finding tenants.

2. Listing your home with a real estate professional can save you time in finding good tenants.

3. Always meet tenants in person before signing a legal agreement.

4. Conduct a background check and gain references to make sure they’re legit.

5 Consider talking with past landlords as well, to get an idea of how trustworthy the tenant is.

These are all great tips for choosing the right tenant! By meeting them in person, conducting a background check, and talking with past landlords, you’ll have a much better idea of whether they’re trustworthy or not

Market Your Rental Property

Now that you’ve decided to rent out your house, it’s time to start marketing it. You’ll want to put your property in as many places as possible so that potential renters can see it. The good news is that there are a lot of ways to do this, and you don’t have to spend a lot of money.

One way to market your rental property is by posting pictures of it on online classifieds websites like Gumtree or Facebook Marketplace. These sites are still among the most popular places where renters look for housing.

Another way to get the word out is by hosting an open house. This will give potential tenants a chance to come and see the property in person and ask questions.

You should also talk with local estate agents who offer rental services. They’ll be able to give you advice on what the rental market looks like in your area and whether or not renting out your house is a good idea right now and may also offer a management service that will fill vacancies and deal with emergency maintenance issues.

Maintain Your Rental Property

Maintaining your rental property is important to ensure that it remains in good condition and continues to attract renters. Here are some tips on how to do this:

- Be proactive and think about cosmetic repairs before you have potential renters come to your rental property. For example, fix any scratches or dents on the walls, repaint any faded areas, and make sure all of the light fixtures are working properly.

- Create a lease agreement that outlines the expectations for both parties and specifies what will happen in emergency situations, where maintenance is required or where the tenant breaks the terms of the lease agreement by causing damage.

- Be prepared to handle any repairs that may need to be done, such as fixing a leaky tap or changing a light bulb. You could do these yourself, or find someone to handle such odd jobs.

If you’re a first time landlord if can be very useful to be in touch with a local estate agent because they can offer guidance on what terms should be included in an agreement, have contact with local trades people and can help you understand will attract renters.

Can You Buy a House and Rent It Out?

Yes, you can buy a home to rent out, but before doing so you need to consider if you should. I’ve loved creating a monthly income from my property portfolio, but it takes a lot of time and effort to build up a good level of rental income.

Start with it as a side hustle, learn from a single property, and in time you can expand, increase the monthly rental income and perhaps even quit the day job.