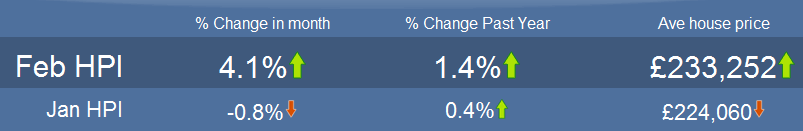

The February HPI from Rightmove has announced the largest jump in asking prices in a decade, with a whopping 4.1% increase – the largest since April 2002.

Rightmove see this as various forces coming together:

- Scarce sellers have been fuelled by cash-rich buyers where demands is exceeding supply

- Increase in mortgage deals, with a 1/3 more products with 10% only deposit

- Investors nationally see property as a lower risk asset class – 5 out of 10 people

- 6 our of 10 people see the market favouring buyers – hence backing up the demand exceeding supply

- Evidence of dormant buyers springing back into life

Obviously it is not clear if the upward pressure on prices can continue, but signs show that this is supportable in various micro-markets that are cash-rich and active – London prices are now within 1% of an all-time high!

Miles Shipside, director at Rightmove comments:

“We’re seeing a strong ‘spring bounce’ in asking prices this year, but the ball is still a lot smaller than it was before the credit crunch as market volumes are constrained. The biggest jump in new sellers’ asking prices for nearly ten years indicates there is pricing power if you are selling the right type of property in the right place where enough potential buyers have access to funding. If your local market does not have those characteristics and your price-pump is based on little more than seasonal optimism and an estate agent’s hot air, then be prepared for buyer response to be a let-down.

However, there are also indications that those who are able to buy but had previously lacked the confidence to take the plunge are of a more positive mindset this year. Perhaps some people are adjusting to the realities, opportunities and strange normality of a low volume but apparently stable property market”

- Homebuilding and Renovating Show Free Tickets - March 19, 2024

- From Fixer-Upper to Dream Home: Investing Returns in Your Property Journey - March 13, 2024

- Leaving on a High Note: Acing Your End of Tenancy Clean - March 13, 2024